Dying without a will can mean your assets are distributed according to Illinois intestacy laws, which may not align with your wishes. Don’t leave the fate of your inheritance to chance. Understanding these laws can empower you to make informed decisions.

Not having a will can result in a lengthy and costly probate process, creating undue stress for loved ones. It can also lead to the distribution of your assets in a way that doesn’t reflect your true intentions.

Illinois Intestacy Laws: Understanding Inheritance Rights Without A Will

Illinois intestacy laws establish a default distribution plan for assets when someone dies without a will. These laws prioritize certain family members, but they may not always align with your specific wishes.

Here are the main points to remember about Illinois intestacy laws:

. If you have a spouse but no children, your spouse inherits everything.

. If you have children but no spouse, your children inherit everything equally.

. If you have no spouse or children, your parents inherit everything.

. If you have neither a spouse, children, nor parents, your siblings inherit everything.

. If you have no living relatives, your assets go to the state of Illinois.

Personal Experience and Deeper Dive into Illinois Intestacy Laws

A few years back, my uncle passed away without a will. As his closest living relative, I was surprised to learn that I was entitled to a portion of his assets under Illinois intestacy laws. While I was grateful for the inheritance, I couldn’t help but wonder if my uncle would have preferred to distribute his assets differently had he created a will.

That experience taught me the importance of having a will. It ensures your assets are distributed according to your wishes, protecting your loved ones from unnecessary legal hassles and potential family disputes.

Inheritance Tax Waiver Form New York State Form Resume Examples – Vrogue – Source www.vrogue.co

History and Myth of Illinois Intestacy Laws

The history of intestacy laws dates back to ancient times, when property was considered an extension of the family. In the absence of a will, the law sought to preserve the family unit by distributing assets to the closest relatives.

One common myth surrounding intestacy laws is that they automatically disinherit spouses. This is not true. In Illinois, a surviving spouse is always entitled to a share of the estate, regardless of whether there is a will.

Florida Intestacy — what are you waiting for? Get your inheritance. – Source www.pankauskilawfirm.com

Hidden Secrets of Illinois Intestacy Laws

Intestacy laws can be complex, with hidden provisions that may affect your inheritance rights. One such provision is known as the “pretermitted heir” rule.

The pretermitted heir rule protects children who are born or adopted after a will is executed. If the will does not provide for these children, they may be entitled to a portion of the estate, even if they are not specifically named in the will.

Estate Planning Attorneys Illinois | Conick Law – Source conicklaw.com

Recommendations for Illinois Intestacy Laws

To avoid the uncertainty and potential pitfalls of intestacy laws, it’s crucial to create a will. Here are some recommendations to consider:

. Discuss your wishes with your family and loved ones.

. Seek legal advice from an experienced estate planning attorney.

. Keep your will up-to-date as your circumstances change.

. Consider creating a trust to supplement your will and provide additional flexibility.

Remember, a will is more than just a legal document; it’s an expression of your wishes and a way to ensure your legacy is preserved according to your intentions.

Free of Charge Creative Commons intestacy laws Image – Keyboard 2 – Source pix4free.org

Intestacy Laws in Other States

Intestacy laws vary from state to state. It’s important to understand the laws that apply to your specific situation. If you have assets in multiple states, you may want to consider creating a will that addresses each state’s laws.

Consult with an estate planning attorney to ensure your will is valid and enforceable in all relevant jurisdictions.

A Guide to Understanding Inheritance Tax Laws in Florida – Source www.floridataxlawyers.com

Tips for Understanding Illinois Intestacy Laws

To better understand Illinois intestacy laws, consider the following tips:

. Read the Illinois Probate Act.

. Attend workshops or seminars on estate planning.

. Consult with an estate planning attorney for personalized guidance.. Share your knowledge with your family and loved ones to foster understanding and avoid potential disputes.

Knowledge is power, and when it comes to your legacy, understanding intestacy laws and creating a will is the ultimate way to empower yourself and your loved ones.

Understanding Estate & Inheritance Taxes in Illinois and Missouri – Source www.sivialaw.com

Intestacy Laws and Digital Assets

With the increasing prevalence of digital assets, it’s essential to consider how intestacy laws apply to these assets.

In Illinois, digital assets are treated as personal property and distributed according to the intestacy laws. However, some online accounts and platforms may have their own terms of service that govern the transfer of digital assets upon death.

Pin on DOCUMENTS – Source www.pinterest.com

Fun Facts About Illinois Intestacy Laws

Did you know that in Illinois, if you die without a will and have no living relatives, your assets go to the Illinois Department of Public Aid?

Another interesting fact is that Illinois recognizes “non-traditional” families. This means that unmarried couples, same-sex couples, and stepchildren may have inheritance rights under intestacy laws.

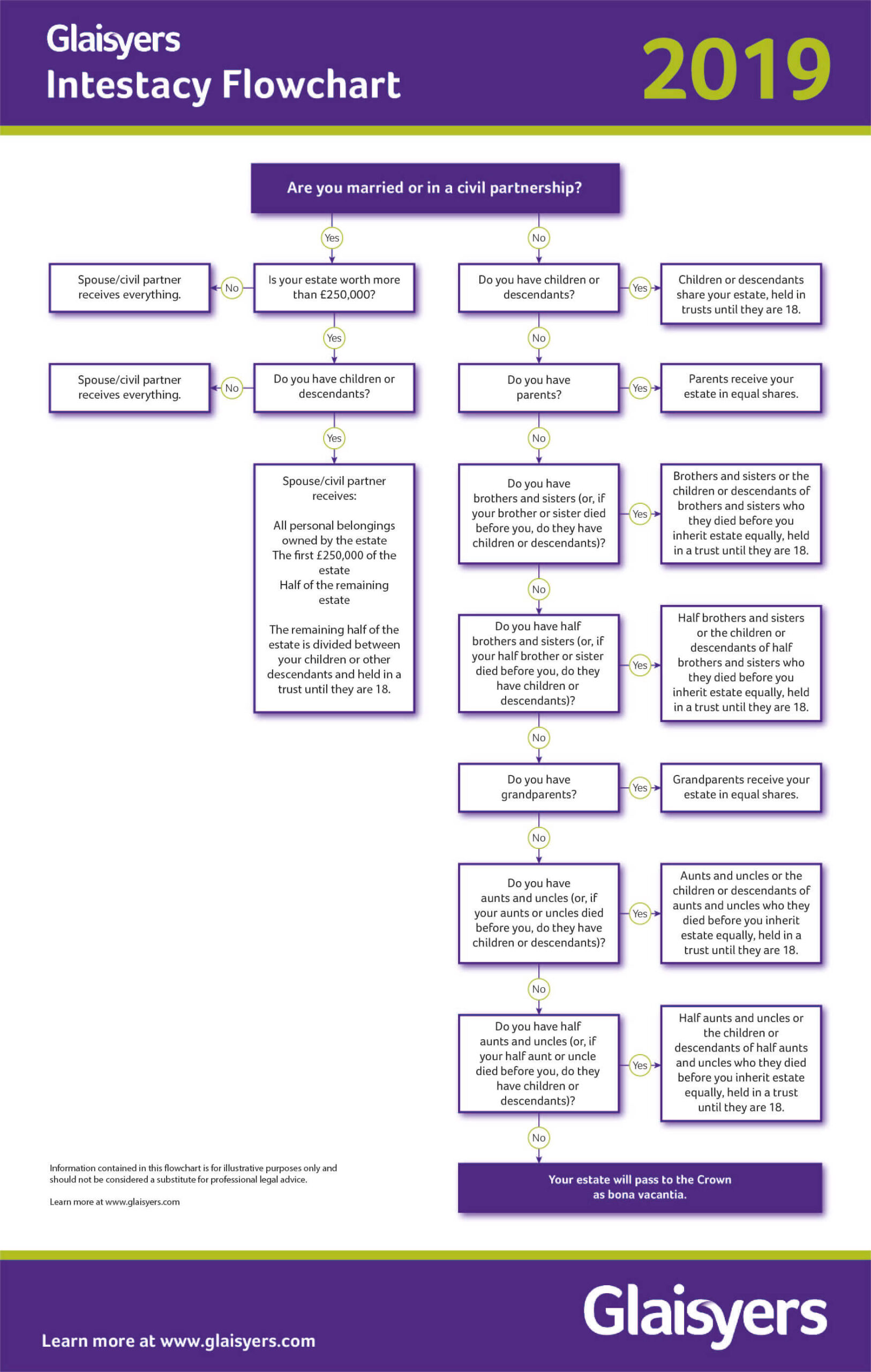

Rules of Intestacy Flowchart 2019: A Guide to Dying without a Will – Source glaisyers.com

How to Avoid Illinois Intestacy Laws

The best way to avoid the application of Illinois intestacy laws is to create a will. A will allows you to specify how your assets should be distributed upon your death.

You can create a will on your own or with the help of an estate planning attorney. It’s important to make sure your will is valid and enforceable under Illinois law.

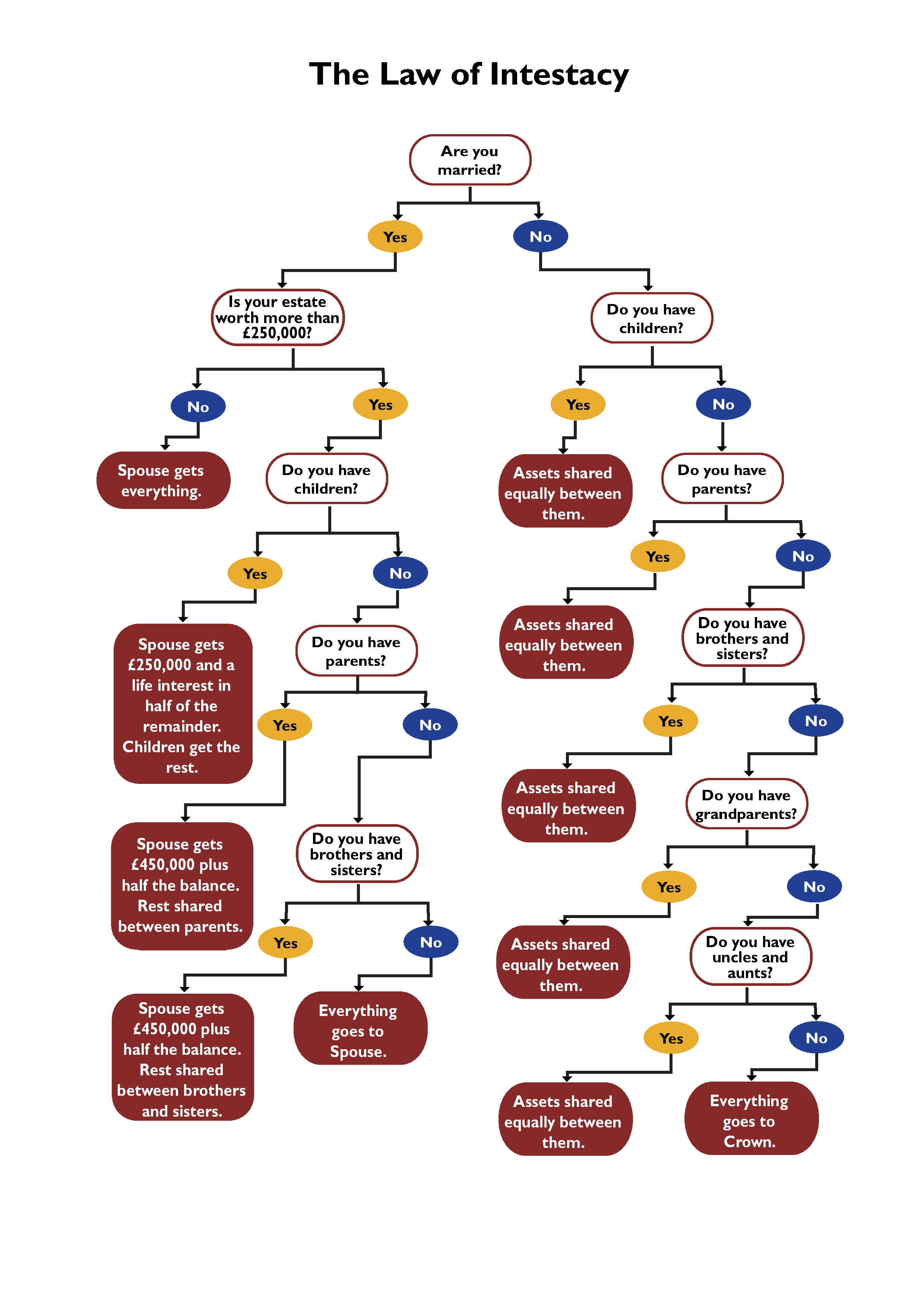

What Are the Rules of Intestacy – Paperblog – Source en.paperblog.com

What if Illinois Intestacy Laws Conflict with My Wishes?

If you have specific wishes for how your assets should be distributed upon your death, you may be concerned about Illinois intestacy laws conflicting with your wishes.

In such cases, it’s crucial to create a will that clearly outlines your wishes. A will can override the default distribution plan established by intestacy laws.

Vagaries of Intestacy Laws and a Simple Solution – EPPL – Source epplasia.com

Listicle of Illinois Intestacy Laws

Here’s a listicle summarizing key points about Illinois intestacy laws:

. If you die without a will, your assets will be distributed according to Illinois intestacy laws.

. Your spouse is always entitled to a share of your estate, regardless of whether there is a will.

. The pretermitted heir rule protects children who are born or adopted after a will is executed.

. Digital assets are treated as personal property and distributed according to intestacy laws.

. You can avoid the application of intestacy laws by creating a will.

By understanding and planning ahead, you can ensure that your assets are distributed according to your wishes, not the default provisions of Illinois intestacy laws.

Question and Answer

Q: What happens if I die without a will in Illinois?

A: Your assets will be distributed according to Illinois intestacy laws.

Q: Who inherits my assets if I die without a spouse or children?

A: Your parents will inherit your assets.

Q: Can I disinherit my spouse in my will?

A: Yes, but your spouse may have the right to contest the will.

Q: What is the pretermitted heir rule?

A: The pretermitted heir rule protects children who are born or adopted after a will is executed.

Conclusion of Illinois Intestacy Laws: Understanding Inheritance Rights Without A Will

Illinois intestacy laws provide a default distribution plan for assets when someone dies without a will. While these laws prioritize certain family members, they may not always align with your wishes.

To protect your legacy and ensure your assets are distributed according to your intentions, it’s crucial to create a will. A will allows you to specify how your assets should be distributed, appoint an executor to manage your estate, and name guardians for your children.