Inheriting Real Estate: Wills And Transfer Of Ownership

When a loved one passes away, the process of inheriting real estate can be both emotionally and legally complex. Wills and other legal documents play a crucial role in determining who inherits property and how the transfer of ownership takes place.

Navigating the Challenges of Inheritance

Inheriting real estate can involve a range of challenges, such as dealing with probate, understanding tax implications, and resolving disputes among heirs. It’s important to seek professional guidance from attorneys and financial advisors to ensure a smooth and legally sound process.

Ensuring a Clear and Fair Transfer of Ownership

Wills serve as legal instructions that dictate the distribution of assets after a person’s death. They can prevent confusion and disputes by clearly outlining who inherits which properties. Proper execution and witnessing of a will are essential to ensure its validity.

Main Points: Inheriting Real Estate

Inheriting real estate involves understanding the legal framework and navigating potential complexities. Wills are central to the process, providing a clear outline of asset distribution and minimizing the likelihood of disputes. Seeking professional guidance is crucial for a smooth transfer of ownership.

team – Wills Transfer – Source www.willstransfer.com

Inheriting Real Estate: Wills And Transfer Of Ownership

My grandmother’s passing left me with a bittersweet inheritance: her beloved Victorian home. As I navigated the legal process of transferring ownership, I realized the importance of understanding wills and the complexities of real estate inheritance.

Through meticulous research and conversations with legal experts, I learned that my grandmother’s will explicitly outlined her wishes for property distribution. This clarity eased the transition and prevented any potential disputes within the family.

Understanding Inheriting Real Estate: Wills And Transfer Of Ownership

Inheriting real estate involves a legal process known as probate, during which a court validates the will and appoints an executor to manage the estate. The executor’s responsibilities include distributing assets, paying debts, and filing taxes.

Depending on the state or country, there may be inheritance taxes or other legal requirements to consider. Understanding these implications can help avoid unexpected financial burdens and ensure a smooth transfer of ownership.

Pin af Barb Miller på Quotes – Source www.pinterest.com

History and Myths of Inheriting Real Estate: Wills And Transfer Of Ownership

Throughout history, inheritance laws have evolved to reflect societal norms and values. In the past, primogeniture, a system where the eldest son inherits the bulk of the estate, was common in many cultures.

Today, most legal systems favor more equitable distribution among heirs. However, myths and misconceptions about inheritance persist, such as the belief that a verbal will is legally binding or that a will can be altered without proper legal procedures.

Uncovering the Hidden Secrets of Inheriting Real Estate: Wills And Transfer Of Ownership

Beyond the legal framework, inheriting real estate often involves emotional and sentimental ties. It can be a time to reflect on the legacy of a loved one and the continuity of family history.

However, there may be hidden secrets or undisclosed issues related to the property. A thorough inspection and review of relevant documents, such as surveys and title reports, can help uncover any potential liabilities or encumbrances.

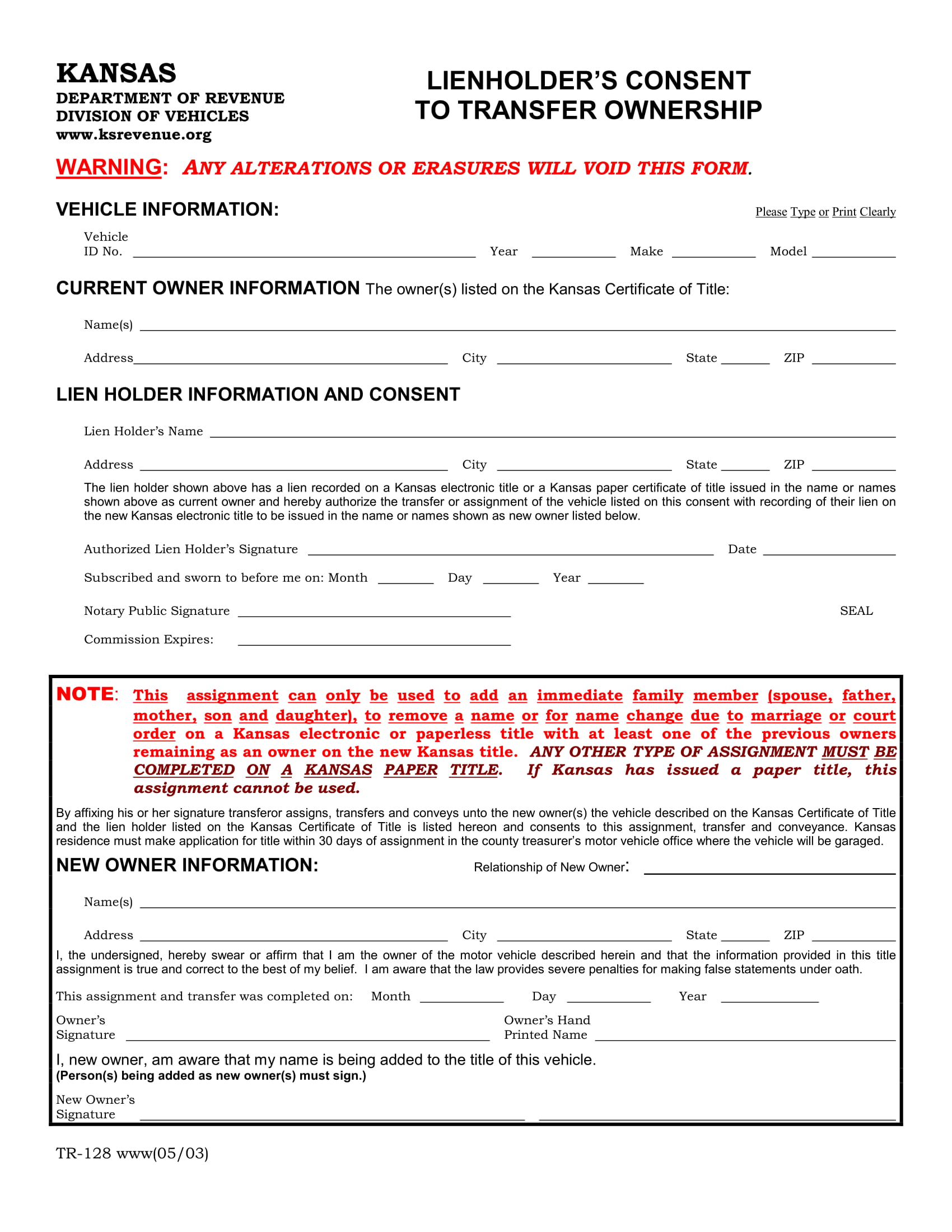

FREE 11+ Legal Ownership Forms in PDF – Source www.sampleforms.com

Recommendations for Inheriting Real Estate: Wills And Transfer Of Ownership

To ensure a smooth and successful inheritance process, consider these recommendations:

- Create a comprehensive will that clearly outlines your wishes for property distribution.

- Seek professional guidance from attorneys and financial advisors to navigate the legal and tax implications.

- Maintain accurate records of property ownership and relevant documents.

- Communicate your intentions with family members to minimize potential disputes.

- Consider the emotional and sentimental value of inherited properties.

Inheriting Real Estate: Wills And Transfer Of Ownership

Inheriting real estate is a significant life event with both legal and personal implications. By understanding the process, navigating potential challenges, and seeking professional guidance when needed, individuals can ensure a clear and fair transfer of ownership that honors the legacy of their loved ones.

Laatste kans op jubelton voor 2023 – Octras – Source octras.nl

Essential Steps for Inheriting Real Estate: Wills And Transfer Of Ownership

To successfully inherit real estate, consider the following essential steps:

- Obtain a copy of the deceased’s will and review its contents.

- Contact the executor of the estate to initiate the probate process.

- File any necessary legal documents and pay applicable taxes.

- Transfer the property into your name through a deed of transfer.

- Update insurance and other relevant accounts to reflect your ownership.

Tips for Inheriting Real Estate: Wills And Transfer Of Ownership

Here are some additional tips to help you navigate the process of inheriting real estate:

- Be patient and allow ample time for the probate process to unfold.

- Communicate openly with family members about the terms of the will.

- Seek legal advice if you have any doubts or concerns.

- Consider the financial implications of inheriting property, including taxes and maintenance costs.

- Preserve the sentimental value of inherited properties by keeping records and sharing stories about their history.

Common Questions and Answers About Inheriting Real Estate: Wills And Transfer Of Ownership

Q: Can I contest a will if I believe it is unfair?

A: Yes, it may be possible to contest a will if you have evidence of undue influence, fraud, or lack of testamentary capacity.

Q: What happens if there is no will?

A: If a person dies without a will, their property will be distributed according to the laws of intestacy in their state of residence.

Q: What are the tax implications of inheriting real estate?

A: Inheritance taxes vary depending on the state or country. It’s important to consult with a financial advisor to understand your specific tax liability.

Q: Can I sell an inherited property before the probate process is complete?

A: In most cases, you cannot sell an inherited property until the probate process is finalized and the title is transferred to you.

Conclusion of Inheriting Real Estate: Wills And Transfer Of Ownership

Inheriting real estate can be a complex and emotionally charged process. By understanding the legal and practical aspects of wills and transfer of ownership, individuals can navigate this experience confidently and ensure that the legacy of their loved ones is preserved.