Navigating probate in Illinois can be a daunting task, especially when dealing with the complexities of estate administration. Independent administration offers a simplified process, but it’s crucial to understand the nuances and complexities involved.

Probate Independent Administration in Texas | Call 281-219-9090 – Source houston-probate-law.com

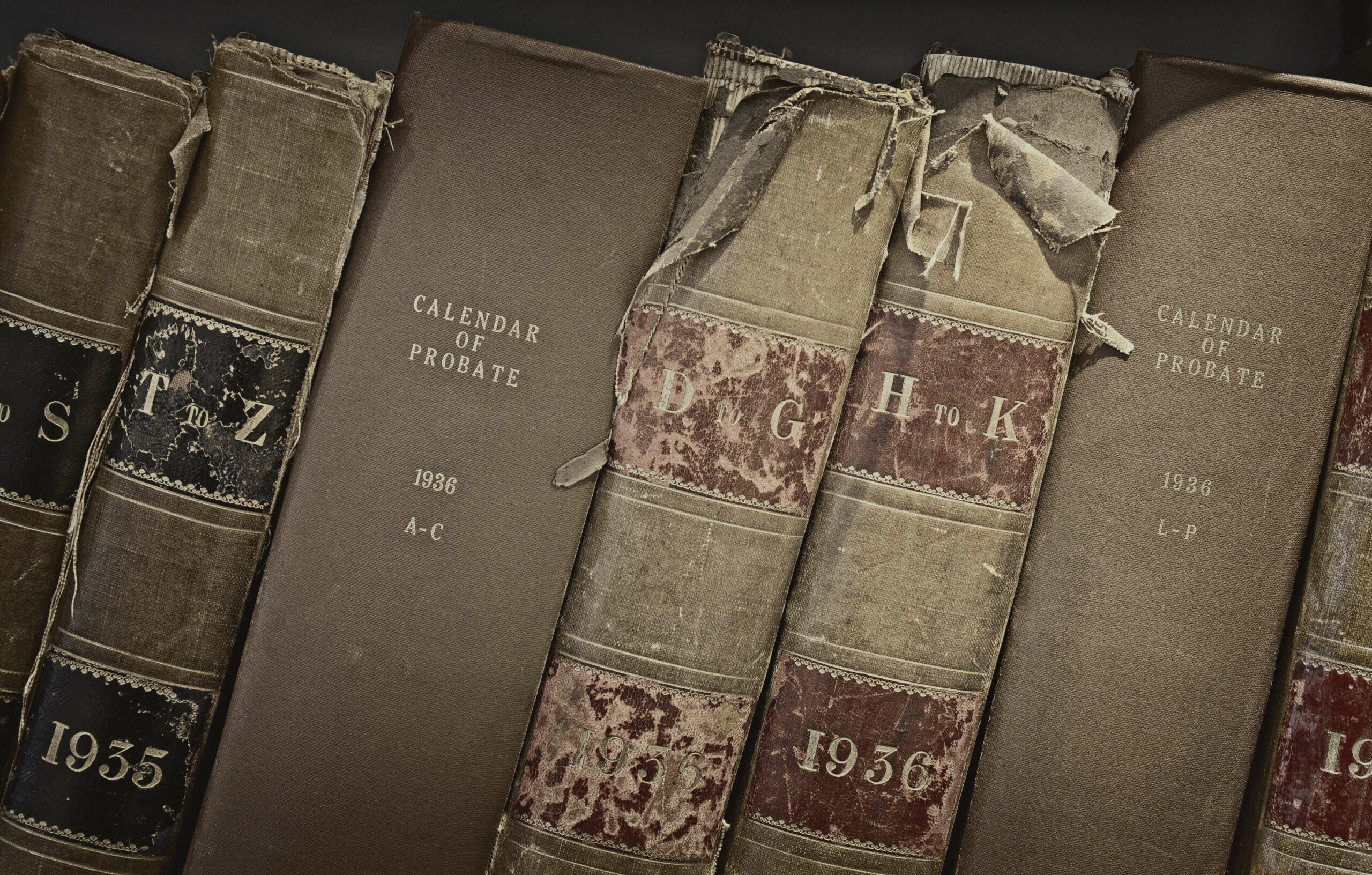

Challenges of Probate

Probate can be a lengthy and costly process, burdened by legal complexities and court supervision. Delays, objections, and disputes can arise, adding to the financial and emotional toll on beneficiaries and executors. Independent administration aims to streamline the process, reduce costs, and provide greater flexibility.

Marshall Browning Estates | Independent Living | Du Quoin, IL 62832 – Source www.aplaceformom.com

Empowerment through Independent Administration

Independent administration allows the executor to manage the estate without direct court supervision. The executor has the authority to distribute assets, pay debts, and make decisions without seeking court approval. This autonomy can expedite the probate process, minimize expenses, and empower the executor to carry out the decedent’s wishes.

Wills and the Administration of Estates – ReviseSQE – Source revise4law.co.uk

Summary:

Independent administration in Illinois provides:

Probate and Administration of Estates – Swinburne, Snowball and Jackson – Source www.swinburnesnowballandjackson.co.uk

Personal Experience with Independent Administration

As an experienced estate planning attorney, I have witnessed firsthand the benefits of independent administration. In one memorable case, the executor of a modest estate faced significant financial constraints. Independent administration allowed us to navigate probate efficiently, avoiding costly court fees and delays. The executor’s ability to make decisions without court approval enabled the estate to be settled promptly and according to the decedent’s wishes.

How Do You Demand An Accounting In A Texas Independent Administration? – Source probatestars.com

Understanding Independent Administration of Illinois Estates

Independent administration is a simplified form of probate in Illinois that grants the executor authority to manage the estate without the need for direct court supervision. This autonomy allows for greater efficiency and cost-effectiveness in administering the estate.

Azalea Estates Gracious Retirement Living | Independent Living | Chapel – Source www.aplaceformom.com

History and Evolution of Independent Administration

The concept of independent administration has been around for centuries, evolving over time to reflect societal and legal changes. In Illinois, independent administration was formally introduced in 1975 and has since become a popular choice for executors due to its streamlined process.

Explore Independent Living at Royal Estates of Wichita Falls, TX – Source www.seniorlifestyle.com

Hidden Secrets of Independent Administration

While independent administration offers numerous advantages, there are potential pitfalls to be aware of. One hidden secret is the need for meticulous record-keeping. The executor must document all transactions, decisions, and disbursements carefully to avoid legal challenges later.

Comprehensive school physical activity programs : putting research into – Source www.pinterest.pt

Recommendations for Effective Independent Administration

To ensure a successful independent administration, consider the following recommendations:

When estates stall: what is the role of independent administration – Source www.ts-p.co.uk

Benefits of Independent Administration in Illinois:

Holiday Grasslands Estates | Independent Living | Wichita, KS 67212 – Source www.aplaceformom.com

Tips for Independent Administration in Illinois

Independent administration requires careful planning and attention to detail. Here are some valuable tips:

Estate Administration in Illinois:

Fun Facts about Independent Administration in Illinois

Did you know?

How to Begin Independent Administration in Illinois

To initiate independent administration, follow these steps:

What if Independent Administration is Not Right for Me?

If independent administration is not suitable for your situation, consider the following alternatives:

Listicle: Essential Aspects of Independent Administration

1. Understanding your responsibilities as executor

2. Communicating with beneficiaries

3. Filing the necessary probate forms

4. Managing estate assets and finances

5. Distributing assets according to the will or intestacy laws

Question and Answer:

1. Q: What are the benefits of independent administration?

A: Streamlined process, reduced costs and delays, greater flexibility, and avoidance of court supervision.

2. Q: Is independent administration right for all estates?

A: No, it’s only available for estates valued at $100,000 or less.

3. Q: What are the potential pitfalls of independent administration?

A: Meticulous record-keeping is crucial to avoid legal challenges.

4. Q: How do I initiate independent administration?

A: File a petition with the court, obtain letters of office, and provide notice to beneficiaries and creditors.

Conclusion of Independent Administration Of Illinois Estates: A Comprehensive Guide

Independent administration of estates in Illinois offers a simplified and cost-effective probate process, but it requires careful planning and understanding of the legal requirements. By empowering the executor with greater autonomy, independent administration can expedite estate settlement and honor the decedent’s wishes.