Have you ever felt overwhelmed by the complexities of tax obligations? The Declaration of Transmission of Tax Formalities and Obligations is here to simplify the process and ensure you stay compliant.

Painful Tax Management

Navigating tax regulations can be a daunting task, especially when you’re dealing with multiple entities or complex financial situations. The burden of filing returns, maintaining records, and meeting deadlines can take a toll on your time and resources.

Declaration of Transmission of Tax Formalities and Obligations

The Declaration of Transmission of Tax Formalities and Obligations is a legal document that allows a taxpayer to transfer their tax obligations to another party, such as a successor or transferee. This can be particularly useful in instances of business transfers or liquidations.

By filing this declaration, the taxpayer can ensure that the transfer of tax responsibilities is officially recognized, and the new party assumes the burden of tax compliance for the subject matter of the transaction.

the skynavia declaration : r/equestriaatwar – Source www.reddit.com

Understanding the Declaration

The Declaration of Transmission of Tax Formalities and Obligations typically includes specific details such as the following:

- Identification of the transferor and transferee

- Description of the subject matter of the transaction

- Date of the effective transfer

- Statement of the taxpayer’s intent to transfer tax obligations

The declaration serves as written evidence of the transfer and helps prevent any confusion or disputes about tax liability.

Download Emergency Declaration 2022 1080p BluRay DD2 0 x264-GalaxyRG – Source watchsomuchproxy.com

Historical Context and Myths

The Declaration of Transmission of Tax Formalities and Obligations has a long history in various legal systems. In some jurisdictions, the concept can be traced back centuries.

While the declaration provides a clear legal framework for transferring tax obligations, there are some misconceptions surrounding it. One myth is that the transfer of tax obligations automatically releases the transferor from all liability. However, the transfer typically only covers specific tax obligations and may not absolve the transferor of all potential tax-related issues arising from the subject matter of the transaction.

Spotlight On: Ann Peña, Tax Office Managing Partner – San Antonio, BDO – Source capitalanalyticsassociates.com

Hidden Secrets of the Declaration

Beyond the formal requirements, the Declaration of Transmission of Tax Formalities and Obligations holds several hidden secrets that can be valuable to taxpayers.

For example, the declaration can be used to clarify tax responsibilities in complex transactions involving multiple parties. It can also facilitate the smooth transition of tax compliance during business restructurings or mergers and acquisitions.

Health & Travel Declaration Form – Source form.gov.sg

Recommendations for Success

To ensure the effectiveness of the Declaration of Transmission of Tax Formalities and Obligations, consider the following recommendations:

- Consult with legal and tax professionals to ensure proper drafting and execution

- File the declaration with the relevant tax authorities promptly

- Maintain a copy of the declaration for legal and compliance purposes

- Communicate the transfer of obligations to all affected parties

Declaration of Transmission of Tax Formalities and Obligations Made Simple

The Declaration of Transmission of Tax Formalities and Obligations is a powerful tool that can help you manage tax obligations efficiently. By understanding its purpose, requirements, and key considerations, you can ensure a smooth and compliant transition of tax responsibilities.

Mochedi-Tax-Logo – Mochedi Tax Practitioners – Source www.mocheditax.co.za

Tips for Execution

Here are some additional tips for successful execution of the Declaration of Transmission of Tax Formalities and Obligations:

- Review relevant tax laws and regulations

- Identify all potential tax liabilities associated with the transaction

- Obtain legal counsel if needed to assist with the drafting and filing process

- Keep detailed records of the transfer

Declaration of Transmission of Tax Formalities and Obligations In Detail

The Declaration of Transmission of Tax Formalities and Obligations is a formal document that outlines the transfer of tax responsibilities from one party to another. It is commonly used in business transactions, such as mergers and acquisitions, where the transferee assumes the tax obligations of the transferor.

The declaration typically includes the following information:

- Name and address of the transferor and transferee

- Description of the transaction

- Date of the transfer

- Tax obligations being transferred

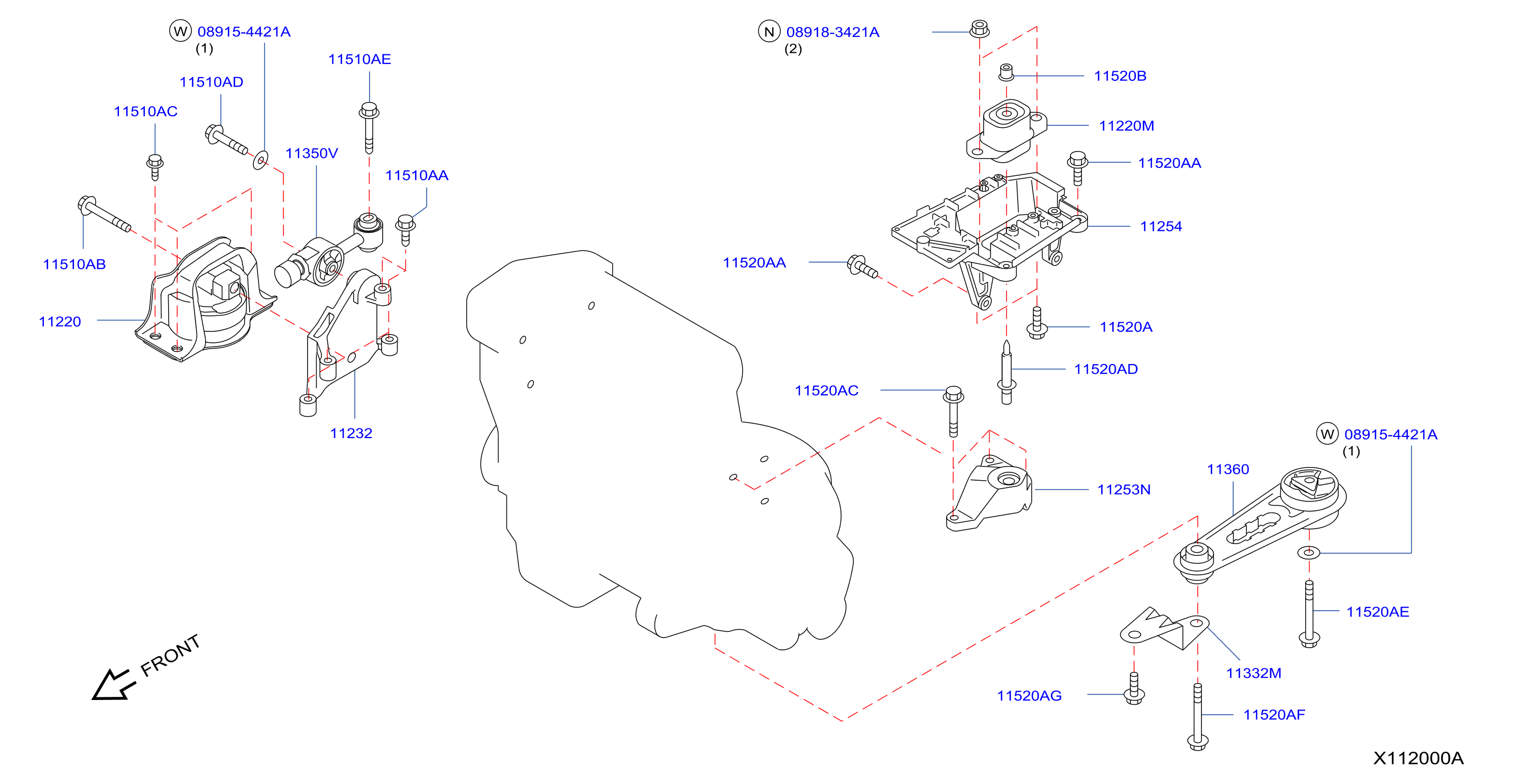

Diagram ENGINE & TRANSMISSION MOUNTING for your Nissan – Source www.nissanpartsoverstock.com

Fun Facts About the Declaration

Here are some fun facts about the Declaration of Transmission of Tax Formalities and Obligations:

- The declaration is not required by law in all jurisdictions

- The format of the declaration may vary depending on the jurisdiction

- The declaration can be used to transfer both domestic and international tax obligations

Despite its legal significance, the Declaration of Transmission of Tax Formalities and Obligations remains a relatively unknown document. By understanding its purpose and requirements, you can ensure a smooth and compliant transfer of tax responsibilities.

Cartier Mens Perfume Gift Sets | Carat Gift Set | Harrods US – Source www.harrods.com

How to File the Declaration

To file the Declaration of Transmission of Tax Formalities and Obligations, you will need to:

- Complete the declaration form

- Gather supporting documentation, such as a copy of the sales agreement

- File the declaration with the relevant tax authorities

The filing process may vary depending on the jurisdiction. It is always advisable to consult with a tax professional to ensure that the declaration is filed correctly.

Pedri makes declaration of intent ahead of World Cup – Football España – Source www.football-espana.net

What If I Don’t File the Declaration?

Failure to file the Declaration of Transmission of Tax Formalities and Obligations may result in penalties and other legal consequences. The specific consequences will vary depending on the jurisdiction.

In some cases, the transferor may remain liable for the tax obligations, even after the transfer. It is therefore important to file the declaration promptly to avoid any potential issues.

Torah PNG – Source pngimg.com

Listicle of Key Points

Here is a listicle of key points about the Declaration of Transmission of Tax Formalities and Obligations:

- The declaration is a legal document that outlines the transfer of tax responsibilities

- It is commonly used in business transactions, such as mergers and acquisitions

- The declaration typically includes the name and address of the transferor and transferee, a description of the transaction, the date of the transfer, and the tax obligations being transferred

- The declaration is not required by law in all jurisdictions

- Failure to file the declaration may result in penalties and other legal consequences

Question and Answer

Q: What is the purpose of the Declaration of Transmission of Tax Formalities and Obligations?

A: The purpose of the declaration is to outline the transfer of tax responsibilities from one party to another.

Q: When is the declaration used?

A: The declaration is commonly used in business transactions, such as mergers and acquisitions.

Q: What information is included in the declaration?

A: The declaration typically includes the name and address of the transferor and transferee, a description of the transaction, the date of the transfer, and the tax obligations being transferred.

Q: Is the declaration required by law in all jurisdictions?

A: No, the declaration is not required by law in all jurisdictions.

Conclusion of Declaration of Transmission of Tax Formalities and Obligations

The Declaration of Transmission of Tax Formalities and Obligations is a powerful tool that can help you manage tax obligations efficiently. By understanding its purpose, requirements, and key considerations, you can ensure a smooth and compliant transfer of tax responsibilities.