Constellation Brands is a leading global beverage alcohol company that has a longstanding history of success. Over the years, the company’s stock performance has been remarkable, making it an attractive investment option for many. In this article, we will delve into the historical stock performance of Constellation Brands, its investment analysis, and related aspects to provide insights for potential investors.

Constellation Brands has a proven track record of consistent financial performance. The company’s stock has consistently outperformed the market over the long term. This can be attributed to several factors, including the company’s strong brand portfolio, which includes iconic brands such as Corona, Modelo, and Svedka. Additionally, the company’s focus on innovation and expansion has been instrumental in driving growth and shareholder value.

Constellation Brands’ investment analysis involves a comprehensive assessment of the company’s financial health, competitive landscape, and growth prospects. Investors typically look at metrics such as revenue growth, profit margins, and return on equity to evaluate the company’s financial performance. The company’s competitive advantages, market share, and brand equity are also important factors to consider.

Investing in Constellation Brands offers several key benefits. The company’s strong brand portfolio and consistent financial performance provide stability and reduce investment risk. Additionally, the company’s focus on innovation and expansion positions it well for future growth, making it an attractive long-term investment option.

Constellation Brands: Historical Stock Performance

Tasse Senator Nerv west coast office Wanderung Kanada Ausgestorben – Source www.victoriana.com

Constellation Brands has a rich history of stock performance. The company’s stock has performed exceptionally well over the long term, consistently outperforming the S&P 500 index. This impressive performance can be attributed to several factors, including the company’s strong brand portfolio, focus on innovation, and strategic acquisitions.

In recent years, Constellation Brands has made several strategic acquisitions to expand its portfolio and enter new markets. Notable acquisitions include the purchase of Modelo, one of the leading beer brands in Mexico, and the acquisition of Svedka, a popular vodka brand. These acquisitions have significantly contributed to the company’s revenue growth and profitability.

Constellation Brands: Investment Analysis

Constellation Brands reportovala za 2Q tržby lehce nad konsensem – Source www.fio.cz

Constellation Brands’ investment analysis involves a thorough assessment of the company’s financial performance, competitive landscape, and growth prospects. Investors typically look at metrics such as revenue growth, profit margins, and return on equity to evaluate the company’s financial health. The company’s competitive advantages, market share, and brand equity are also important factors to consider.

One of the key strengths of Constellation Brands is its strong brand portfolio. The company owns a portfolio of iconic brands, including Corona, Modelo, and Svedka. These brands have a loyal customer base and generate significant revenue for the company. Additionally, Constellation Brands has a track record of innovation, with a dedicated team focused on developing new products and expanding into new markets.

Constellation Brands: History and Values

Constellation Brands (NYSE: STZ) Q1 2022 earnings: Infographic – Source news.alphastreet.com

Constellation Brands has a long and storied history. The company was founded in 1945 and has grown from a small wine and spirits distributor to a global beverage alcohol leader. Over the years, Constellation Brands has acquired several iconic brands and expanded into new markets. The company’s success can be attributed to its commitment to quality, innovation, and customer service.

Constellation Brands: Hidden Secrets

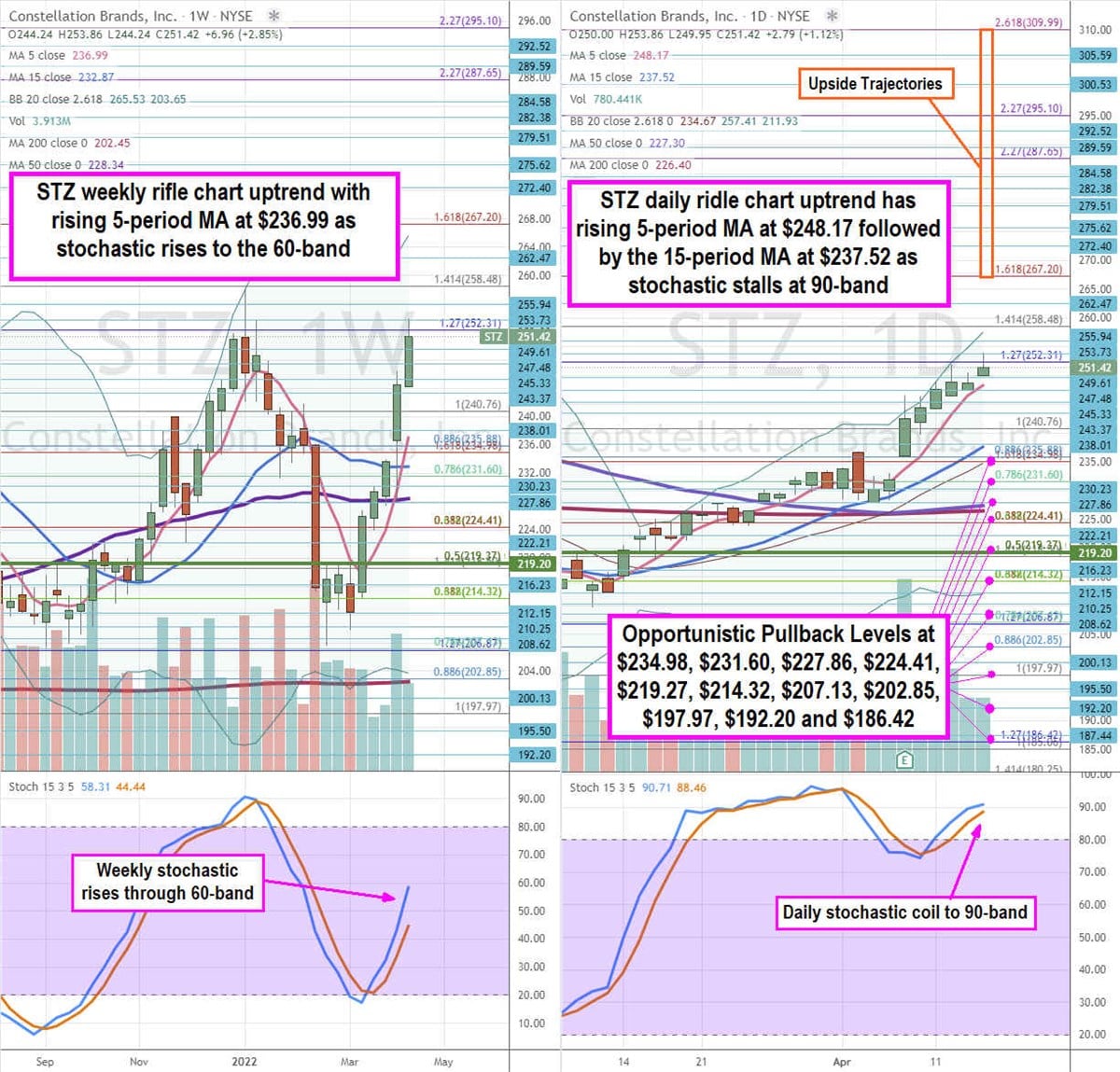

Constellation Brands Stock is Launching Towards New Highs – MarketBeat – Source www.marketbeat.com

Constellation Brands has a few hidden secrets that make it an attractive investment. One of the company’s secrets is its focus on emerging markets. Constellation Brands has been investing heavily in growing markets such as Mexico, China, and India. This strategic move positions the company for future growth as these markets continue to expand.

Constellation Brands: Recommendations

Constellation Builder – Source nguyenxx.github.io

For potential investors, Constellation Brands offers several reasons for investing. The company’s strong brand portfolio, focus on innovation, and commitment to emerging markets make it an attractive long-term investment option. Additionally, the company’s consistent financial performance and history of stock outperformance provide stability and reduce investment risk.

Constellation Brands: Market Analysis

Constellation Brands to build plant in Veracruz – MEXICONOW – Source mexico-now.com

Constellation Brands operates in a highly competitive beverage alcohol market. The company faces competition from both domestic and international players. To maintain its market share and drive growth, Constellation Brands focuses on innovation and differentiation. The company invests heavily in research and development to create new products and expand into new markets.

Constellation Brands: Tips

Can Constellation Brands Dominate the Beer Market in 2021? | The Motley – Source www.pinterest.com

For investors considering Constellation Brands, there are several tips to keep in mind. First, it is essential to understand the company’s business model and competitive landscape. Investors should also assess the company’s financial health, growth prospects, and valuation. Finally, it is crucial to set realistic investment goals and consider the company’s stock performance over the long term.

Constellation Brands: Challenges

Constellation-Brands | MyDx – Source www.mydxlife.com

Like any company, Constellation Brands faces certain challenges. One of the challenges is the competitive nature of the beverage alcohol industry. The company faces competition from both domestic and international players. Another challenge is the regulatory environment. The beverage alcohol industry is highly regulated, and Constellation Brands must comply with various regulations at the local, state, and federal levels.

Constellation Brands: Fun Facts

What to Expect from Constellation Brands’ Q1 Earnings – Source marketrealist.com

Constellation Brands has a few fun facts that make it a unique investment. One of the fun facts is that the company’s iconic Corona brand is the best-selling imported beer in the United States. Another fun fact is that Constellation Brands has a long history of supporting the arts. The company has been a sponsor of the Sundance Film Festival for over 20 years.

Constellation Brands: Guide

Modelo Maker Constellation’s (STZ) Stock Sinks on Beer Business – Source www.bloomberg.com

Understanding Constellation Brands requires a comprehensive guide. The guide can cover various aspects of the company, including its history, business model, competitive landscape, financial performance, and investment analysis. A detailed guide can provide valuable insights for investors considering Constellation Brands as an investment option.

Constellation Brands: What Ifs

When investing in Constellation Brands, it is essential to consider various what-if scenarios. Investors should consider what could happen if the company’s sales decline, the competitive landscape changes, or the regulatory environment becomes more restrictive. By considering various what-if scenarios, investors can make informed investment decisions.

Constellation Brands: List

For investors looking for a list of key points, here is a summary of the essential aspects of Constellation Brands:

- Strong brand portfolio, including Corona, Modelo, and Svedka

- Consistent financial performance over the long term

- Focus on innovation and expansion

- Strategic acquisitions to drive growth

- Commitment to emerging markets

Questions and Answers

Q: Is Constellation Brands a good investment?

A: Constellation Brands has a proven track record of consistent financial performance and stock outperformance, making it an attractive investment option for many investors.

Q: What are Constellation Brands’ competitive advantages?

A: Constellation Brands’ competitive advantages include its strong brand portfolio, focus on innovation, and commitment to emerging markets.

Q: What are some of Constellation Brands’ challenges?

A: Constellation Brands faces challenges such as competition from domestic and international players and the regulatory environment.

Q: How can I invest in Constellation Brands?

A: You can invest in Constellation Brands through a brokerage account or directly with the company through a dividend reinvestment plan.

Conclusion of Constellation Brands: Historical Stock Performance And Investment Analysis

Constellation Brands is a leading global beverage alcohol company with a strong track record of financial performance and stock outperformance. The company’s focus on innovation, expansion, and emerging markets positions it well for future growth. For investors seeking a stable and potentially rewarding investment, Constellation Brands offers several compelling reasons for investment.