Understanding insurance deductible structures can be a daunting task for many. Embedded and aggregate deductibles are two common types of deductible structures, but what do they mean and how do they differ? This guide will provide a comprehensive overview of embedded vs. aggregate deductibles, helping you make informed decisions about your insurance coverage.

Choosing the right type of deductible can significantly impact your insurance premiums and out-of-pocket expenses. Not fully understanding the differences between embedded and aggregate deductibles can lead to financial surprises down the road.

Embedded Vs. Aggregate Deductibles: Understanding Insurance Deductible Structures

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Embedded deductibles are specific to each coverage or benefit within an insurance policy. For example, a health insurance policy may have an embedded deductible for doctor’s visits, another for prescription drugs, and a third for hospitalizations.

Aggregate deductibles, on the other hand, apply to the entire policy. This means that you only need to meet the deductible once, regardless of the number of claims you make within a specific period, usually a year.

How Do Insurance Deductibles Work? | Lemonade – Source www.lemonade.com

Understanding Embedded Deductibles

Embedded deductibles are often used in health insurance policies. They require you to meet a separate deductible for each specific service or benefit. For instance, if your health insurance policy has a $200 embedded deductible for doctor’s visits, you’ll need to pay the first $200 of each doctor’s visit before your insurance starts covering the costs.

Embedded deductibles can help lower your insurance premiums, but they can also increase your out-of-pocket expenses if you have multiple medical expenses within a year.

Aggregate vs. Stacked Health Insurance Deductibles — Wayfinder™ – Source wayfindervt.com

Understanding Aggregate Deductibles

Aggregate deductibles are more common in property and casualty insurance policies, such as homeowners or auto insurance. With an aggregate deductible, you only need to meet the deductible once, regardless of the number of claims you make during the policy period.

For example, if your homeowners insurance policy has a $500 aggregate deductible, you’ll need to pay the first $500 of covered losses before your insurance starts covering the costs. After you meet the deductible, your insurance will cover the remaining costs up to the policy limits.

How Do Embedded Deductibles Impact Your Health Insurance? – Source www.agilerates.com

History and Myth of Embedded Vs. Aggregate Deductibles

The concept of deductibles in insurance policies has been around for centuries. The first known use of deductibles can be traced back to ancient Greece, where merchants would pool their resources to cover the costs of unexpected events.

Over time, deductibles have evolved to become an integral part of insurance policies. Today, deductibles are used to reduce the cost of insurance premiums and encourage policyholders to be more responsible for their own risk management.

Healthcare Benefits – Santander eGuide- SHUSA/NEW HIRE – Source businessolver.foleon.com

Hidden Secret of Embedded Vs. Aggregate Deductibles

One of the hidden secrets of embedded vs. aggregate deductibles is that they can be used to customize your insurance coverage. By choosing the right type of deductible, you can tailor your policy to meet your specific needs and budget.

For example, if you have a high deductible health plan (HDHP) with an embedded deductible, you can save money on your premiums. However, you’ll need to be prepared to pay more out of pocket for medical expenses until you meet your deductible.

Glossary of Health Insurance Terms – Axia Women’s Health – Source axiawh.com

Recommendation of Embedded Vs. Aggregate Deductibles

The best type of deductible for you will depend on your individual circumstances. If you have a limited budget, a high deductible plan with an embedded deductible may be a good option. However, if you’re more comfortable with lower out-of-pocket expenses, an aggregate deductible may be a better choice.

It’s important to carefully consider your options and consult with an insurance professional before making a decision. They can help you understand the pros and cons of each type of deductible and choose the one that’s right for you.

Calendar Year Deductible Embedded | Calendar Printables Free Templates – Source calendarinspirationdesign.com

Embedded Deductibles vs. Aggregate Deductibles: Which Is Right for You?

The best way to determine which type of deductible is right for you is to consider your individual circumstances. Here are some questions to ask yourself:

- What is my budget?

- How often do I expect to use my insurance?

- What is my risk tolerance?

Once you have a good understanding of your needs, you can start shopping for insurance policies. Be sure to compare the different types of deductibles and premiums before making a decision.

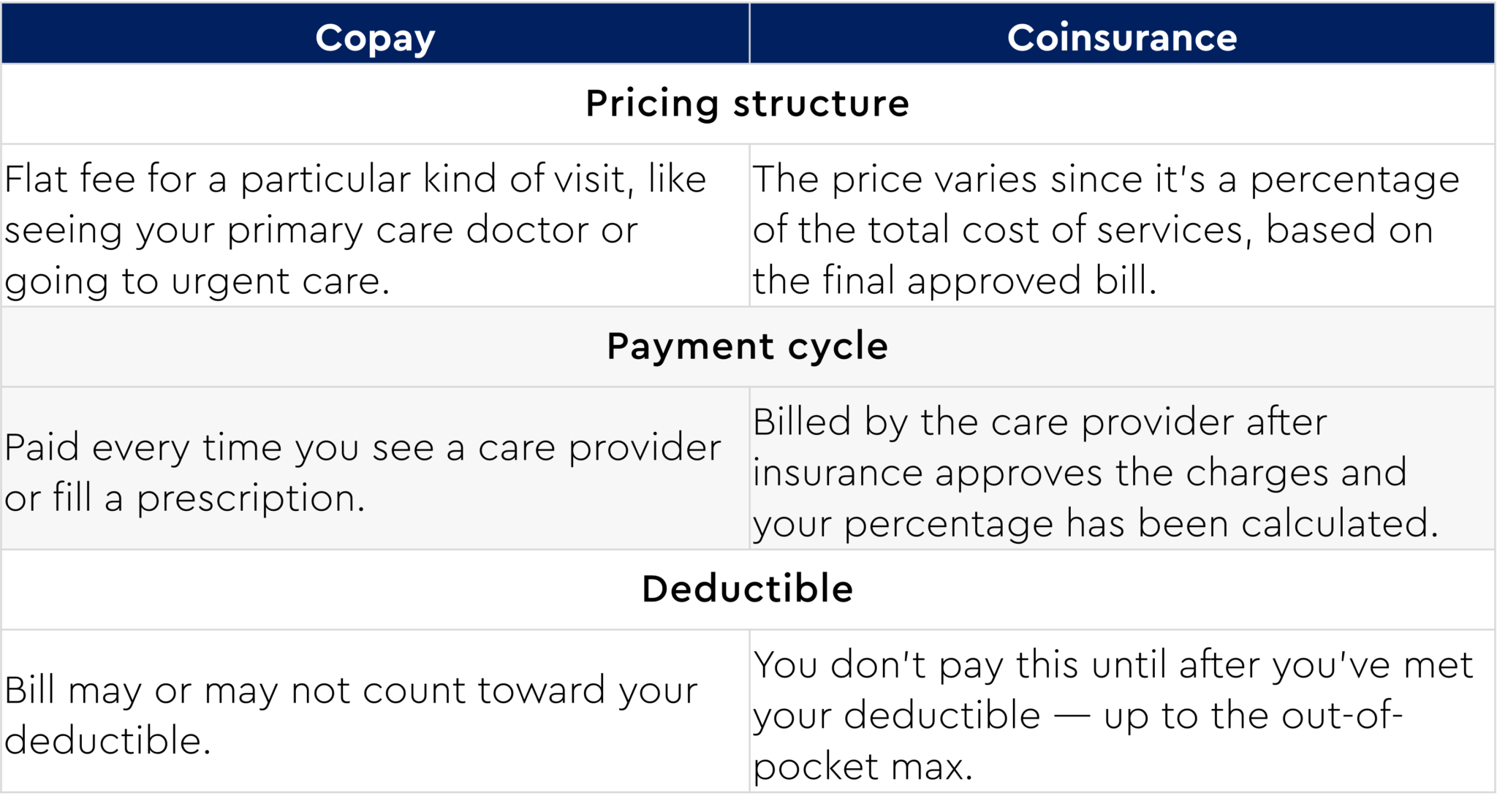

The Definitive Guide to Understanding Copays, Coinsurance, and – Source tritonhealthplans.com

Tips for Choosing the Right Deductible

Here are some tips for choosing the right deductible:

- Consider your budget. A higher deductible will lower your premiums, but it will also increase your out-of-pocket expenses.

- Estimate your expected medical expenses. If you expect to have high medical expenses, a lower deductible may be a better choice.

- Think about your risk tolerance. If you’re comfortable with taking on more risk, a higher deductible may be a good option.

Choosing the right deductible can save you money and give you peace of mind. By following these tips, you can make an informed decision.

How Do Car Insurance Deductibles Work – WA Group – Source walivebig.com

Fun Facts About Deductibles

Here are some fun facts about deductibles:

- The average car insurance deductible is $500.

- The average health insurance deductible is $1,500.

- Some insurance policies have no deductible.

Did you know that you can sometimes negotiate your deductible with your insurance company?

WHAT IS DEDUCTIBLES IN INSURANCE? – Protect Insurance Info – Source protectinsuranceinfo.com

How to Lower Your Deductible

If you’re looking to lower your deductible, there are a few things you can do:

- Increase your insurance premiums. This is the most direct way to lower your deductible.

- Take a defensive driving course. This can lower your car insurance deductible.

- Install safety features in your home. This can lower your homeowners insurance deductible.

Lowering your deductible can save you money in the long run, but it’s important to weigh the pros and cons before making a decision.

![Tax Deductions: The New Rules [INFOGRAPHIC] - Alloy Silverstein Tax Deductions: The New Rules [INFOGRAPHIC] - Alloy Silverstein](https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png)

Tax Deductions: The New Rules [INFOGRAPHIC] – Alloy Silverstein – Source alloysilverstein.com

What If I Can’t Afford My Deductible?

If you can’t afford to pay your deductible, there are a few things you can do:

- Contact your insurance company. They may be able to work with you to create a payment plan.

- Look into government assistance programs. There are several programs that can help low-income individuals pay for their deductibles.

- Consider crowdfunding. There are several websites that allow you to raise money from friends and family to help pay for your deductible.

Don’t let the cost of your deductible prevent you from getting the medical care you need.

Listicle of Embedded Vs. Aggregate Deductibles

Here’s a listicle of the key differences between embedded and aggregate deductibles:

- Embedded deductibles are specific to each coverage or benefit within an insurance policy.

- Aggregate deductibles apply to the entire policy.

- You only need to meet an embedded deductible once per coverage or benefit.

- You only need to meet an aggregate deductible once per policy period.

- Embedded deductibles can help lower your insurance premiums, but they can also increase your out-of-pocket expenses.

- Aggregate deductibles can provide more predictable out-of-pocket expenses, but they can also lead to higher insurance premiums.

By understanding the differences between embedded and aggregate deductibles, you can make an informed decision about which type of deductible is right for you.

Questions and Answers About Deductibles

Here are some frequently asked questions about deductibles:

- What is the difference between an embedded deductible and an aggregate deductible?

- Embedded deductibles are specific to each coverage or benefit within an insurance policy, while aggregate deductibles apply to the entire policy.

- Which type of deductible is better?

- The best type of deductible for you will depend on your individual circumstances.

- How can I lower my deductible?

- You can lower your deductible by increasing your insurance premiums, taking a defensive driving course, or installing safety features in your home.

- What if I can’t afford my deductible?

- If you can’t afford to pay your deductible, you can contact your insurance company, look into government assistance