In the ever-evolving world of investing, choosing the right brokerage platform is crucial to maximize your returns and minimize risks. Fidelity and Stash stand out as leading options, but understanding their distinctions is essential before making a decision. This comprehensive guide will delve into the key features, advantages, and disadvantages of Fidelity vs. Stash, empowering you to make an informed choice that aligns with your financial goals.

Choosing a brokerage firm can be a daunting task, especially when faced with the overwhelming options available. Both Fidelity and Stash offer unique benefits that cater to different types of investors. Fidelity boasts a long-standing reputation and comprehensive investment offerings, while Stash appeals to novice investors with its user-friendly platform and commission-free trading.

Fidelity Vs. Stash: Choosing The Best Brokerage For Your Needs

Fidelity Vs Robinhood: Find The Safest Brokerage Platform – Source fxreviews.best

In the realm of investing, Fidelity and Stash emerge as formidable contenders, each offering a distinct set of advantages and drawbacks. Fidelity, an industry titan, has cemented its position with decades of experience and vast investment options. In contrast, Stash, a relative newcomer, has gained traction among novice investors seeking a user-friendly and low-cost platform.

Fidelity Vs. Stash: Choosing The Best Brokerage For Your Needs – A Tale Of Two Brokers

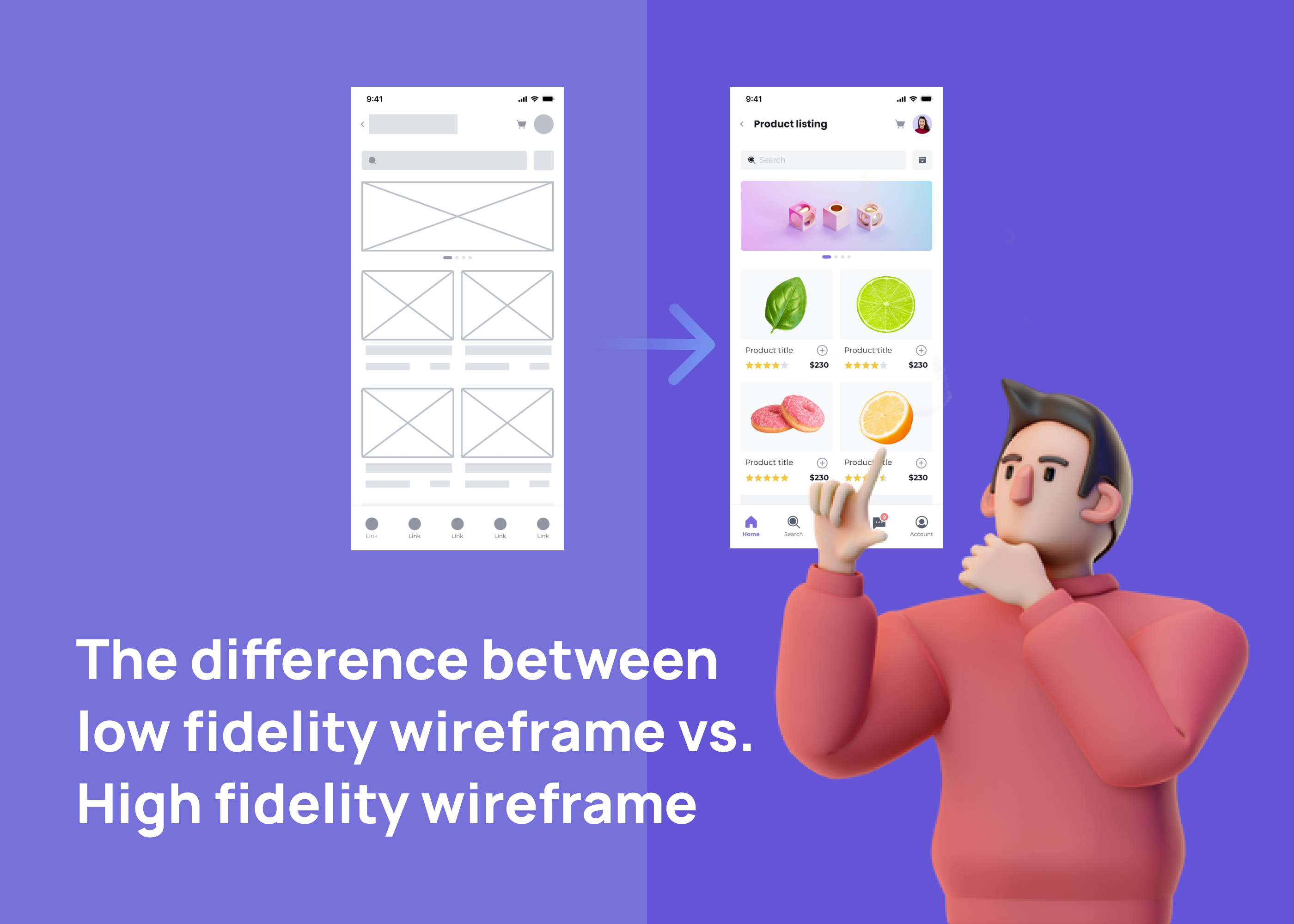

Low fidelity vs. High fidelity wireframe: What are the differences and – Source www.visily.ai

Fidelity and Stash represent two sides of the brokerage spectrum. Fidelity, a veteran in the industry, has built a loyal customer base through its vast investment offerings and robust research tools. On the other hand, Stash targets novice investors with its intuitive platform and educational resources. Understanding the nuances of each platform will empower you to make an informed decision based on your unique investment needs.

Fidelity Vs. Stash: Choosing The Best Brokerage For Your Needs – A Historical Perspective

Weed Stash box CBD/THC Combo with Rolling Tray ROLLIN’ TIME CLASSIC – Source rollinbox.com

Fidelity’s legacy spans over 75 years, establishing it as a pillar of the financial industry. Throughout its storied history, Fidelity has weathered market fluctuations and technological advancements, continuously adapting to the evolving needs of investors. Conversely, Stash is a relatively young player, founded in 2015, yet has swiftly gained popularity among millennials and Gen Z investors.

Fidelity Vs. Stash: Choosing The Best Brokerage For Your Needs – Unveiling The Hidden Secrets

hogwarts-legacy-fidelity-vs-performance-3 | For The Win – Source ftw.usatoday.com

Beyond the surface-level distinctions, Fidelity and Stash harbor hidden strengths and weaknesses that may sway your decision. Fidelity’s extensive research capabilities grant investors access to in-depth market analysis and expert insights. In contrast, Stash’s automated investing feature simplifies the investment process for those seeking a hands-off approach.

Fidelity Vs. Stash: Choosing The Best Brokerage For Your Needs – Our Recommendation

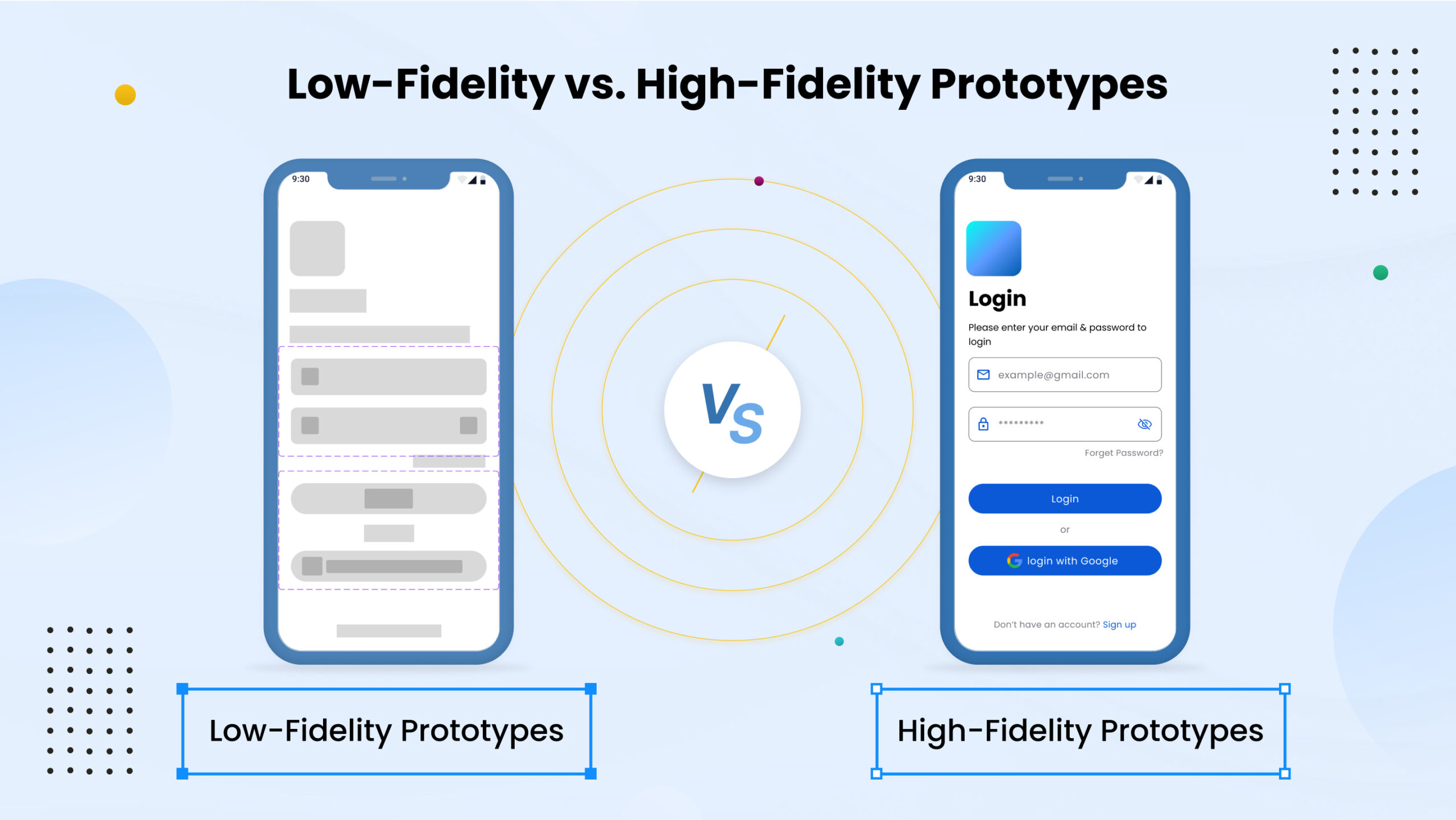

Low-Fidelity vs. High-Fidelity Prototypes | Blog – Source apponward.com

The choice between Fidelity and Stash hinges on your individual investing preferences and goals. If you value extensive investment options, robust research tools, and a proven track record, Fidelity stands out as the superior choice. However, if you prioritize ease of use, commission-free trading, and automated investing, Stash is the more suitable option. Ultimately, the best brokerage for you is the one that aligns with your unique financial aspirations.

Fidelity Vs. Stash: Choosing The Best Brokerage For Your Needs – A Comprehensive Comparison

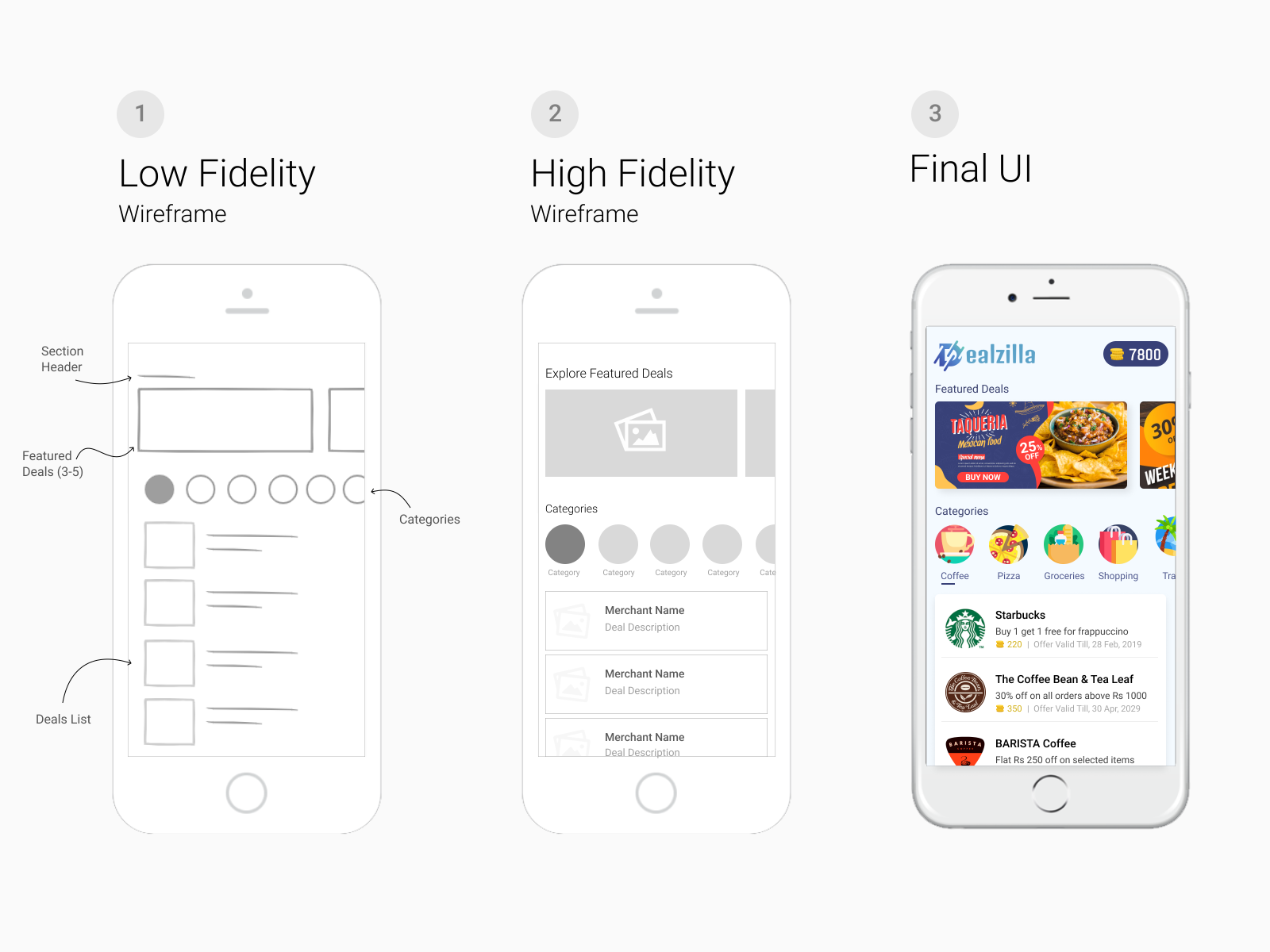

Low Fidelity Vs High Fidelity Wireframes | Uizard – Source uizard.io

To further aid your decision-making process, let’s delve into a comprehensive comparison of Fidelity vs. Stash. We will examine key aspects such as account types, investment offerings, fees, customer support, and educational resources. By weighing these factors against your individual preferences, you can make an informed choice that sets you on the path to financial success.

Fidelity Vs. Stash: Choosing The Best Brokerage For Your Needs – Tips For Making The Right Choice

Low Fidelity vs High Fidelity by Thilina Pitiwala on Dribbble – Source dribbble.com

Navigating the world of brokerage platforms can be overwhelming. Here are some invaluable tips to assist you in making the right choice between Fidelity and Stash:

- Assess your investment goals and risk tolerance.

- Research both platforms thoroughly and compare their offerings.

- Consider your budget and account size.

- Read reviews and testimonials from other investors.

Fidelity Vs. Stash: Choosing The Best Brokerage For Your Needs – Making Sense Of The Differences

TIAA CREF vs Fidelity: Choosing the Right Investment Company – Invest – Source investsmartinsights.com

Despite their similarities, Fidelity and Stash differ in several key areas. These distinctions can significantly impact your investment experience. Here’s a summary of the most notable differences:

- Investment Options: Fidelity offers a wider range of investment options, including stocks, bonds, mutual funds, ETFs, and options. Stash, on the other hand, focuses primarily on ETFs, fractional shares, and robo-investing.

- Fees: Fidelity offers commission-free trading for online stock and ETF trades. Stash charges a monthly subscription fee for its automated investing service.

- Research Tools: Fidelity provides robust research tools and market analysis, including charts, news, and analyst ratings. Stash offers limited research capabilities but emphasizes educational content for novice investors.

Fidelity Vs. Stash: Choosing The Best Brokerage For Your Needs – Fun Facts

Vanguard vs. Fidelity vs. Schwab | The WealthAdvisor – Source www.thewealthadvisor.com

Beyond the core features, Fidelity and Stash have unique quirks and achievements that may pique your interest:

- Fidelity was founded by Ned Johnson in 1946 and is headquartered in Boston, Massachusetts.

- Stash was co-founded by Brandon Krieg and Ed Robinson in 2015 and is based in New York City.

- Fidelity is the largest mutual fund company in the world.

- Stash is a member of the FDIC and SIPC, ensuring the safety of your investments up to certain limits.

Fidelity Vs. Stash: Choosing The Best Brokerage For Your Needs – How To Get Started

Low Fidelity vs. High Fidelity: Your Guide to Prototyping | Maestro – Source meetmaestro.com

Once you’ve made your decision, getting started with either Fidelity or Stash is straightforward:

- Visit the Fidelity or Stash website and open an account.

- Provide your personal and financial information.

- Fund your account by transferring money from another bank or brokerage.

- Start investing in your chosen investments.

Fidelity Vs. Stash: Choosing The Best Brokerage For Your Needs – What If Scenarios

Before making a final decision, consider these “what if” scenarios:

- What if I’m a beginner investor? Stash is a more suitable choice with its user-friendly platform and educational resources.

- What if I want to trade options? Fidelity offers options trading, while Stash does not.

- What if I need robust research tools? Fidelity provides comprehensive research tools, while Stash’s research capabilities are limited.