HMO Vs. PPO: Understanding The Differences And Choosing The Best Plan For You

Navigating the complexities of health insurance can be overwhelming. Understanding the key differences between HMOs and PPOs is crucial for making an informed decision about the best plan for your needs. This post will delve into the intricacies of HMOs and PPOs, highlighting their unique features and empowering you to choose the optimal plan for your health and financial well-being.

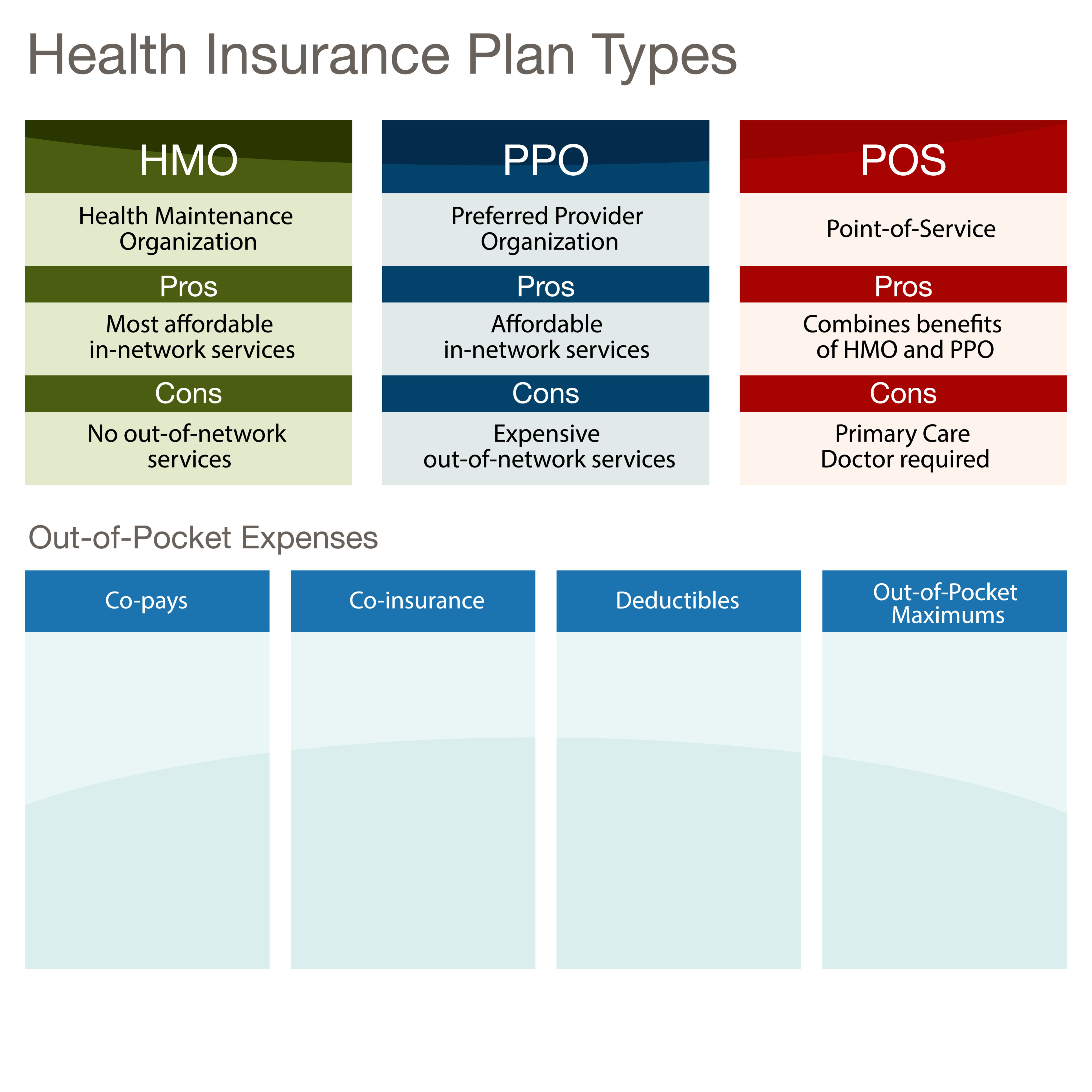

When selecting a health insurance plan, it’s essential to consider factors such as flexibility, cost, and access to healthcare providers. HMOs (Health Maintenance Organizations) and PPOs (Preferred Provider Organizations) offer distinct approaches to healthcare that cater to different preferences and circumstances.

Understanding HMOs

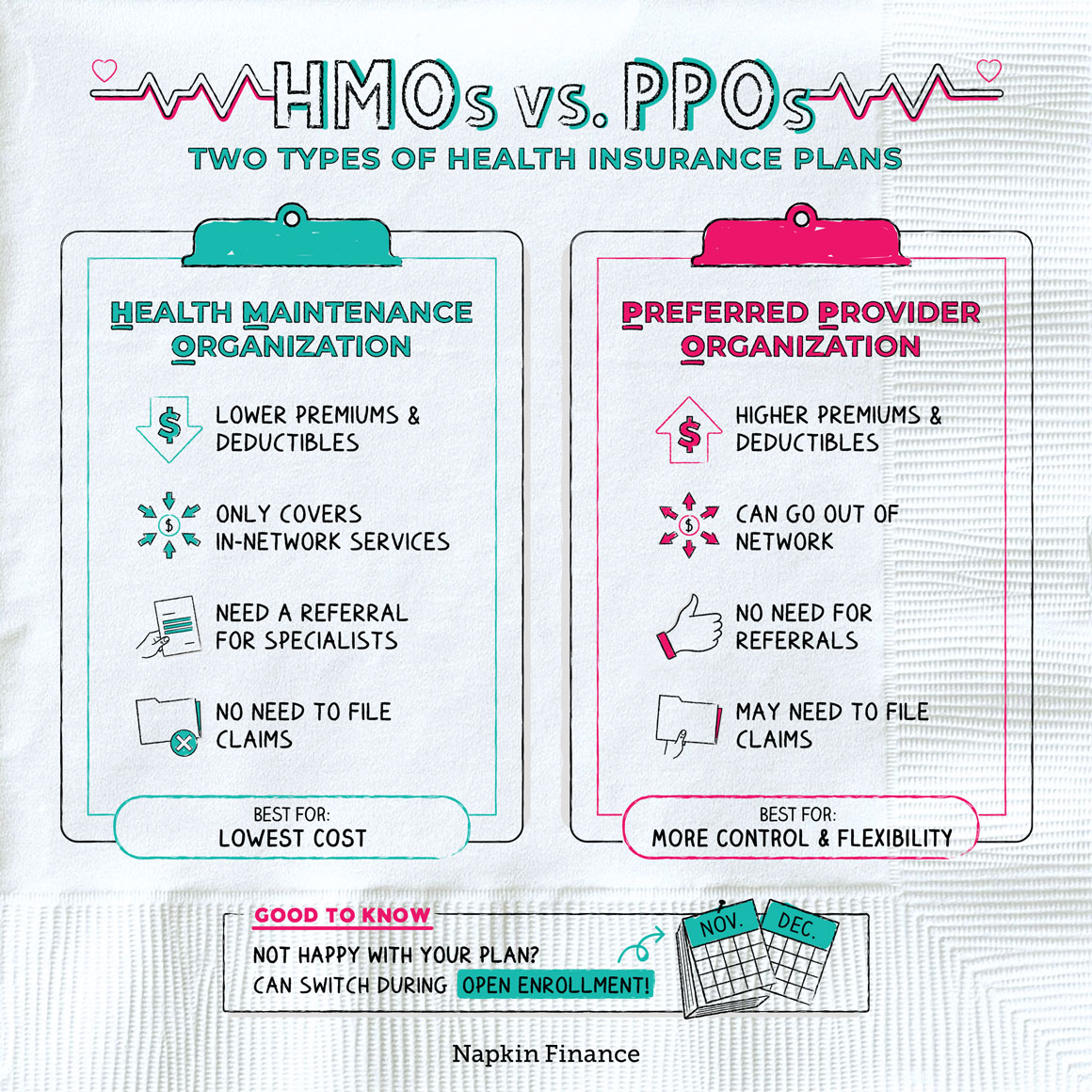

HMOs prioritize cost-effectiveness and streamlined access to care within a specific network of providers. They typically have lower premiums and co-pays compared to PPOs. HMO members choose a primary care physician (PCP) who serves as their gatekeeper, coordinating all medical care and referrals to specialists. By limiting the choice of providers, HMOs can negotiate discounted rates with healthcare providers, resulting in lower out-of-pocket expenses for members.

Whats a pos – inkgasw – Source inkgasw.weebly.com

Understanding PPOs

PPOs offer greater flexibility in choosing healthcare providers, including both in-network and out-of-network options. Members can visit any provider without a referral, although out-of-network care may incur higher costs. PPOs typically have higher premiums and co-pays than HMOs, but they provide more freedom in selecting providers. This flexibility may be beneficial for those who prefer a wider range of healthcare options or have specialized medical needs.

Is HMO or PPO Better? | Types of HMO vs. PPO Insurance Plans – Source claritybenefitsolutions.com

History and Myths Surrounding HMOs and PPOs

HMOs have been around since the 1970s and have evolved over time to meet the changing needs of healthcare consumers. Initially, HMOs were criticized for limiting patient choice and restricting access to specialists. However, modern HMOs have addressed these concerns by expanding provider networks and implementing more flexible plans.

HMO vs PPO Health Insurance: What Are the Differences? – Digital Trends – Source digitaltrendsreport.com

PPOs, introduced in the 1980s, gained popularity due to their greater flexibility and wider provider networks. However, PPOs also have their detractors, who argue that they can lead to higher out-of-pocket costs for out-of-network care. It’s important to note that the reputation of HMOs and PPOs can vary depending on the specific plan and insurance provider.

Tips for Choosing the Best Plan

When selecting an HMO or PPO, consider your healthcare needs, budget, and preferences. If cost is a primary concern and you’re comfortable with a limited provider network, an HMO may be a suitable option. However, if you value flexibility and want the freedom to choose your healthcare providers, a PPO may be a better fit.

Why Choose a PPO Plan? – Easy Affordable Health Insurance – Source www.ezaffordablehealthinsurance.com

Expert Insight

Dr. Emily Carter, a healthcare expert, emphasizes the importance of understanding the terms and conditions of any HMO or PPO plan before enrolling. She advises, “Carefully review the provider network, premiums, deductibles, and co-pays to ensure that the plan aligns with your healthcare needs and financial situation.”

Fun Facts about HMOs and PPOs

HMOs are often associated with lower administrative costs due to their streamlined healthcare delivery system. PPOs, on the other hand, have more administrative expenses due to the broader provider network and the need to process out-of-network claims.

Anthem Blue – Source anthem-blue.blogspot.com

Conclusion

HMOs and PPOs offer distinct advantages and disadvantages. Understanding the key differences between these two types of health insurance plans is essential for making an informed decision that aligns with your healthcare needs and financial constraints. By carefully considering the factors discussed in this post, you can choose the best plan that provides the coverage, flexibility, and cost-effectiveness you require.