When it comes to understanding the stock market, investors and companies need to be aware of the impact of Form 144 filings. These filings can have a significant impact on the price of a company’s stock, and it is important to understand how they work.

The Importance of Understanding Form 144 Filings

Geometrische Elementsatzsammlung Der Form 144. Abstraktes Clipart – Source de.dreamstime.com

Form 144 filings are required by the Securities and Exchange Commission (SEC) when an insider, such as a company officer or director, wants to sell a large amount of stock. These filings provide investors with important information about the potential sale of a large number of shares, which can affect the price of the stock.

What is Form 144?

ESG and Sustainable Investing: A Guide for ESG-Focused Investors in – Source community.nasscom.in

Form 144 is a disclosure document that must be filed with the SEC by an insider who wants to sell a large amount of stock. The form provides information about the insider, the amount of stock that will be sold, and the date of the sale.

History and Myths of Form 144

RDOF Eligible Areas Map – CostQuest Associates – Source www.costquest.com

Form 144 was created in 1972 to help prevent insider trading. Before Form 144 was created, insiders could sell large amounts of stock without disclosing their intentions to the SEC or the public. This could lead to insider trading, where insiders would sell their stock before bad news was released to the public.

The Hidden Secret of Form 144

5 Biggest Trucking Companies in the World – Insider Monkey – Source www.insidermonkey.com

The hidden secret of Form 144 is that it can be used to identify potential insider trading. When an insider files a Form 144, it is a signal that they are planning to sell a large amount of stock. This information can be used by investors to make informed decisions about whether or not to buy or sell the stock.

Recommendations for Understanding Form 144

Ryan Cohen Twitter Gamestop – Source d179susierodriquez.blogspot.com

If you are an investor, it is important to understand Form 144 and how it can impact the price of a company’s stock. Here are a few recommendations for understanding Form 144:

- Read the Form 144 carefully. The form provides important information about the insider, the amount of stock that will be sold, and the date of the sale.

- Consider the context of the Form 144. Is the insider selling a large number of shares? Is the insider selling all of their shares? These factors can help you assess the potential impact of the sale on the price of the stock.

- Make informed decisions. After you have considered the Form 144 and the context of the sale, you can make an informed decision about whether or not to buy or sell the stock.

How to Interpret Form 144 Filings

When interpreting Form 144 filings, it is important to consider the following factors:

- The number of shares being sold

- The insider’s relationship to the company

- The reason for the sale

- The market conditions

Tips for Understanding Form 144

A Theater Coming To Near You Soon In Mount Kisco | Chappaqua, NY Patch – Source patch.com

Here are a few tips for understanding Form 144:

- Be aware of the different types of Form 144 filings. There are four different types of Form 144 filings, each of which has different requirements.

- Know the deadlines for filing Form 144. Insiders must file Form 144 at least two business days before they sell the stock.

- Understand the penalties for failing to file Form 144. Insiders who fail to file Form 144 may be subject to civil and criminal penalties.

Is Form 144 Important?

Form 144 is an important document that provides investors with information about the sale of large amounts of stock by insiders.

Fun Facts about Form 144

Form 10-K: SEC Annual Report Filing Format and Sections – Source www.wallstreetprep.com

Here are a few fun facts about Form 144:

- Form 144 was created in 1972.

- Form 144 is named after the Securities Act of 1933, which requires the registration of securities with the SEC.

- Form 144 is available on the SEC’s website.

How to Use Form 144

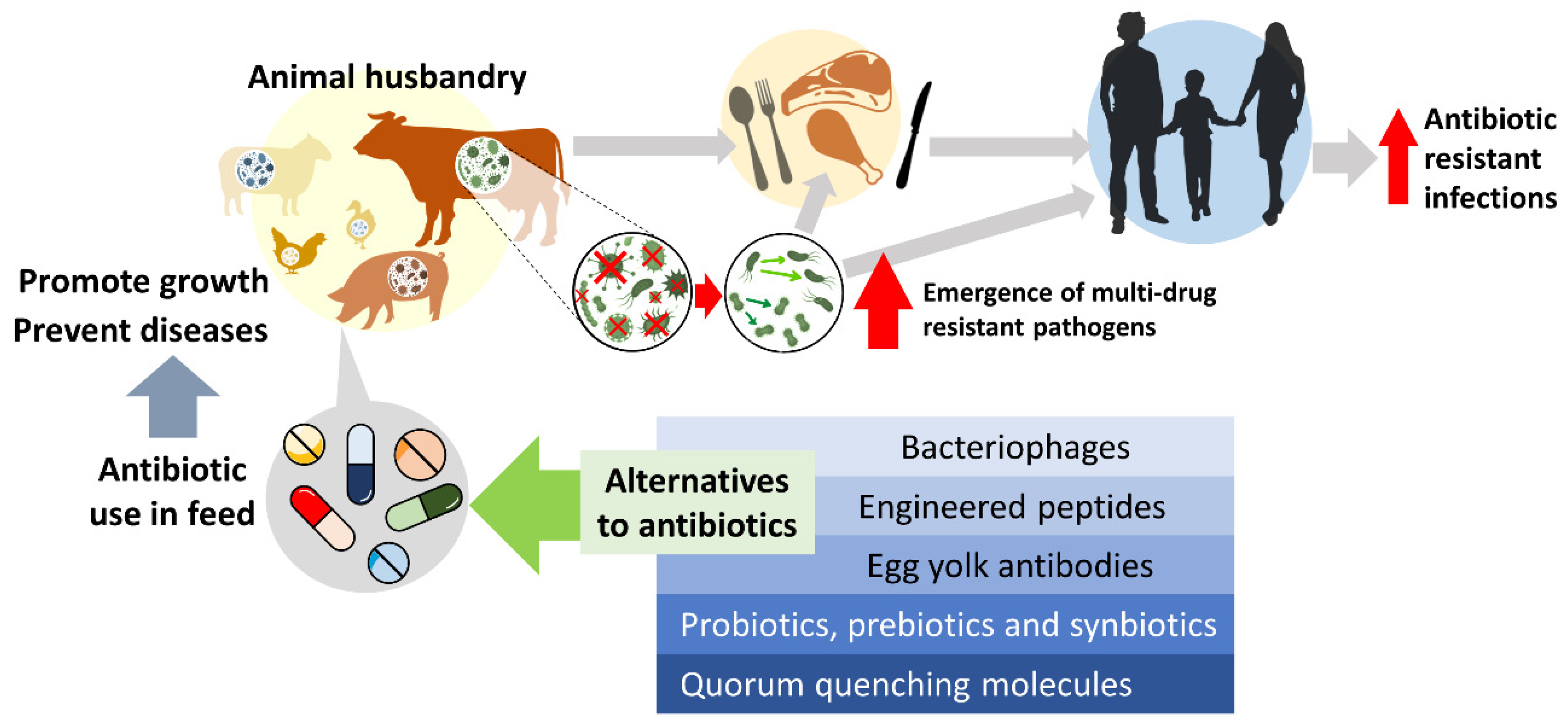

How Do Antibiotics Promote Growth In Animals – astonishingceiyrs – Source astonishingceiyrs.blogspot.com

To use Form 144, you must be an insider who wants to sell a large amount of stock. You must file Form 144 with the SEC at least two business days before you sell the stock.

What if I Don’t File Form 144?

If you fail to file Form 144, you may be subject to civil and criminal penalties.

Listicle of Form 144

Next Stop, Wabtec: GE Completes Spin-Off And Merger Of Its – Source www.ge.com

Here is a listicle of Form 144:

- Form 144 is a disclosure document that must be filed with the SEC by an insider who wants to sell a large amount of stock.

- Form 144 was created in 1972 to help prevent insider trading.

- Form 144 is named after the Securities Act of 1933, which requires the registration of securities with the SEC.

- Form 144 is available on the SEC’s website.

- To use Form 144, you must be an insider who wants to sell a large amount of stock.

Question and Answer

Here are some questions and answers about Form 144:

- What is Form 144?

- Who must file Form 144?

- When must Form 144 be filed?

- What are the penalties for failing to file Form 144?

Conclusion of Unveiling The Impact Of Form 144 Filings: A Guide For Investors And Companies

Form 144 is an important document that provides investors with information about the sale of large amounts of stock by insiders. It is important to understand Form 144 and how it can impact the price of a company’s stock.