Are you looking for ways to maximize your tax savings with a Wex HSA? Our comprehensive guide will walk you through everything you need to know about eligible expenses and help you make the most of your account.

Navigating the world of Wex HSA eligible expenses can be a daunting task. But understanding what qualifies and what doesn’t can help you save big on taxes.

A Wex HSA (Health Savings Account) is a tax-advantaged savings account that allows you to set aside money for qualified medical expenses. Contributions to your HSA are tax-deductible, and withdrawals for eligible expenses are tax-free.

To summarize, Wex HSA Eligible Expenses: A Comprehensive Guide For Maximizing Tax Savings will help you understand what expenses are eligible for reimbursement from your HSA, how to track your expenses, and how to maximize your tax savings.

Wex HSA Eligible Expenses: A Personal Experience

I’ve been using a Wex HSA for over five years now, and it’s saved me thousands of dollars on taxes. I use my HSA to pay for everything from doctor’s visits to prescription drugs to dental care.

16 Surprising FSA and HSA Eligible Expenses Your Employees Should Know – Source beinoventive.com

It’s been a great way to save money on my healthcare costs, and it’s also given me peace of mind knowing that I have a safety net in case of a medical emergency.

If you’re not already using a Wex HSA, I highly recommend opening one. It’s a great way to save money on your healthcare costs and reduce your tax burden.

Wex HSA Eligible Expenses: The Basics

So, what exactly are eligible expenses for a Wex HSA? The IRS has a comprehensive list of qualified medical expenses, which you can find on their website.

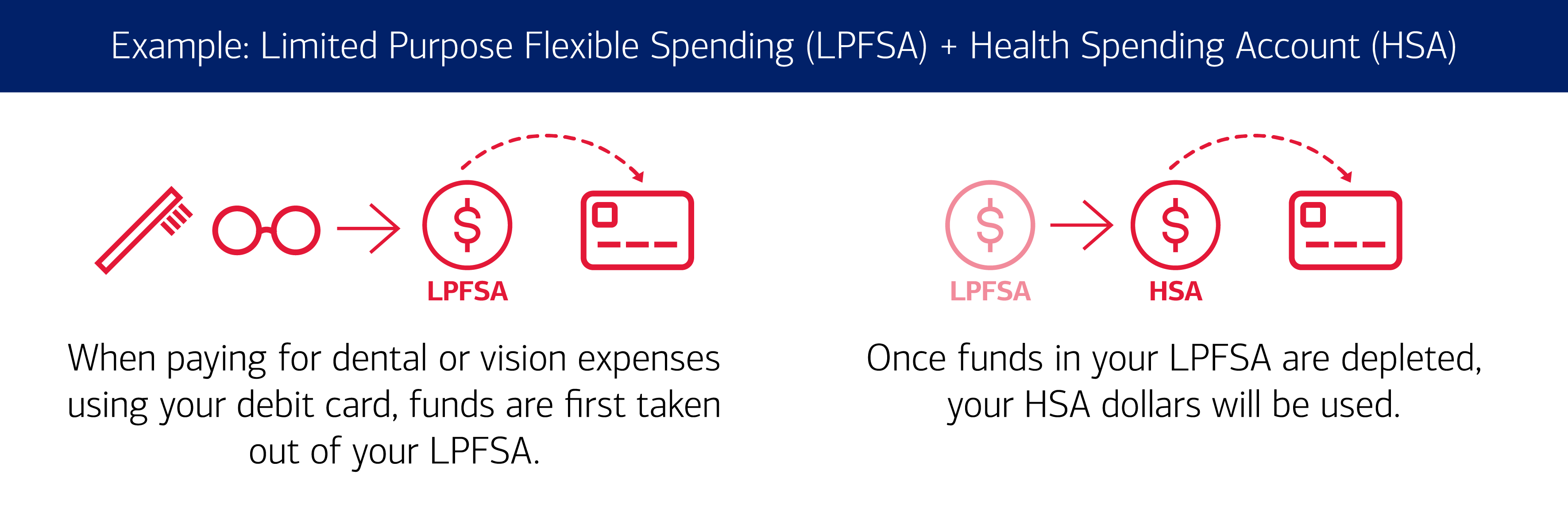

Using your Health and Benefit Visa® debit card – Source healthaccounts.bankofamerica.com

In general, any expense that is related to the diagnosis, treatment, or prevention of a medical condition is eligible for reimbursement from your HSA. This includes expenses such as:

- Doctor’s visits

- Hospital stays

- Prescription drugs

- Dental care

- Vision care

Wex HSA Eligible Expenses: The Hidden Secrets

In addition to the basic eligible expenses, there are also a number of hidden secrets that can help you maximize your tax savings with a Wex HSA.

Eligible Expenses – Starship – Source www.starshiphsa.com

For example, you can use your HSA to pay for over-the-counter medications, as long as they are recommended by your doctor. You can also use your HSA to pay for transportation costs to and from medical appointments.

If you have a flexible spending account (FSA), you can also use your HSA to reimburse yourself for eligible expenses that you paid for with your FSA. This is a great way to double-dip on your tax savings.

Wex HSA Eligible Expenses: Recommendations

Here are a few recommendations for maximizing your tax savings with a Wex HSA:

- Contribute the maximum amount to your HSA each year.

- Use your HSA to pay for all of your eligible medical expenses.

- Keep track of your expenses and receipts.

- Invest your HSA funds to grow your savings.

Can I Use My HSA and FSA for Vision Expenses? – GoodRx – Source www.goodrx.com

By following these recommendations, you can maximize your tax savings and make the most of your Wex HSA.

Wex HSA Eligible Expenses: A Deeper Dive

If you’re looking for more information on Wex HSA eligible expenses, there are a number of resources available.

- The IRS website has a comprehensive list of qualified medical expenses.

- Your HSA provider can also provide you with information on eligible expenses.

- There are also a number of books and articles available on the topic.

Wex HSA Eligible Expenses: Tips

Here are a few tips for using your Wex HSA to pay for eligible expenses:

- Keep your receipts for all of your eligible expenses.

- Submit your receipts to your HSA provider for reimbursement.

- If you have any questions about whether or not an expense is eligible, contact your HSA provider.

New Expenses Now Eligible for your HSA & FSA Funds – Flyte HCM – Source flytehcm.com

By following these tips, you can avoid any problems with your HSA and make the most of your tax savings.

Wex HSA Eligible Expenses: Fun Facts

Did you know that you can use your Wex HSA to pay for the following expenses?

- Cosmetic surgery (if it’s medically necessary)

- Weight loss surgery (if it’s medically necessary)

- Acupuncture

- Massage therapy

“Our Printable Tax Deduction Tracker is a handy tool for organizing and – Source www.pinterest.com

These are just a few of the many expenses that you can use your Wex HSA to pay for. So, if you’re looking for ways to save money on your healthcare costs, a Wex HSA is a great option.

Wex HSA Eligible Expenses: How To

If you’re ready to start using your Wex HSA to pay for eligible expenses, here’s how to do it:

- Log in to your HSA account.

- Click on the “Reimbursements” tab.

- Enter the amount of the expense.

- Select the category of the expense.

- Attach a receipt for the expense.

- Click on the “Submit” button.

![Are Sunglasses FSA / HSA Eligible? [Full List of Approved Expenses] Are Sunglasses FSA / HSA Eligible? [Full List of Approved Expenses]](https://www.oakleyforum.com/guides/wp-content/uploads/2022/04/Sunglasses-with-FSA-and-HSA-scaled.jpg)

Are Sunglasses FSA / HSA Eligible? [Full List of Approved Expenses] – Source www.oakleyforum.com

Your HSA provider will review your request and process it within a few days. If your request is approved, the funds will be deposited into your bank account.

Wex HSA Eligible Expenses: What If

What if you use your Wex HSA to pay for an ineligible expense?

If you use your Wex HSA to pay for an ineligible expense, you will have to pay income tax on the amount of the expense. You may also have to pay a penalty of 10%.

Can I use my HSA for my dogs vet bills? Leia aqui: Is there a pet – Source fabalabse.com

To avoid paying taxes and penalties, it’s important to keep track of your eligible expenses and only use your HSA to pay for those expenses.

Wex HSA Eligible Expenses: Listicle

Here is a listicle of some of the most common Wex HSA eligible expenses:

- Doctor’s visits

- Hospital stays

- Prescription drugs

- Dental care

- Vision care

- Over-the-counter medications (with a doctor’s recommendation)

- Transportation costs to and from medical appointments

- Long-term care insurance premiums

- Health insurance premiums (if you are not eligible for Medicare)

HSA: The Best Retirement Account | From Meager to Money in 2021 – Source www.pinterest.com

Question and Answer

- What is a Wex HSA?

A Wex HSA is a tax-advantaged savings account that allows you to set aside money for qualified medical expenses.

- What are eligible expenses for a Wex HSA?

Eligible expenses for a Wex HSA include any expense that is related to the diagnosis, treatment, or prevention of a medical condition.

- How can I use my Wex HSA to pay for eligible expenses?

You can use your Wex HSA to pay for eligible expenses by logging in to your HSA account and submitting a reimbursement request.

- What happens if I use my Wex HSA to pay for an ineligible expense?

If you use your Wex HSA to pay for an ineligible expense, you will have to pay income tax on the amount of the expense. You may also have to pay a penalty of 10%.

Conclusion of Wex HSA Eligible Expenses: A Comprehensive Guide For Maximizing Tax Savings

A Wex HSA is a great way to save money on your healthcare costs and reduce your tax burden. By understanding what expenses are eligible for reimbursement and following the tips in this guide, you can maximize your tax savings and make the most of your HSA.