Are you looking for a way to ensure that your property is transferred to your loved ones after you pass away? A transfer-on-death deed may be the right option for you.

Transferring property ownership in Illinois can be a complex and time-consuming process. A transfer-on-death deed can simplify the process and avoid probate, which is the court-supervised process of distributing your assets after you die.

What is a Transfer-on-Death Deed?

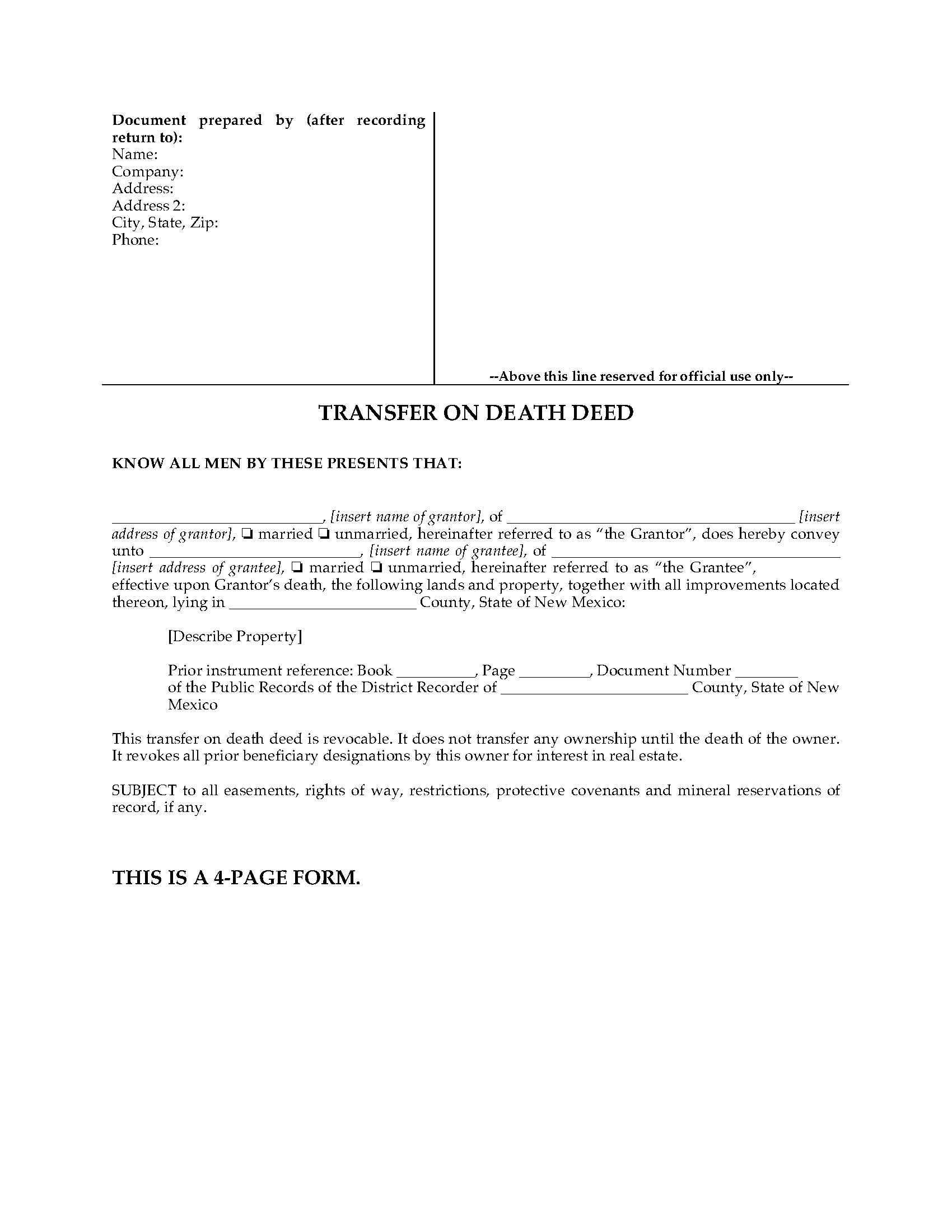

Revocable Transfer-On-Death Deeds (aka Lady Bird Deed) New Since 2016 – Source www.attorneysecrets.com

A transfer-on-death deed is a legal document that allows you to transfer ownership of your property to one or more beneficiaries after your death. The deed is recorded with the county recorder’s office in the county where the property is located. When you die, the deed will automatically transfer ownership of the property to your beneficiaries without having to go through probate.

Transfer-on-death deeds are a simple and effective way to ensure that your property is transferred to your loved ones according to your wishes. They can also help you avoid the costs and delays of probate.

History and Myths of Transfer-on-Death Deeds

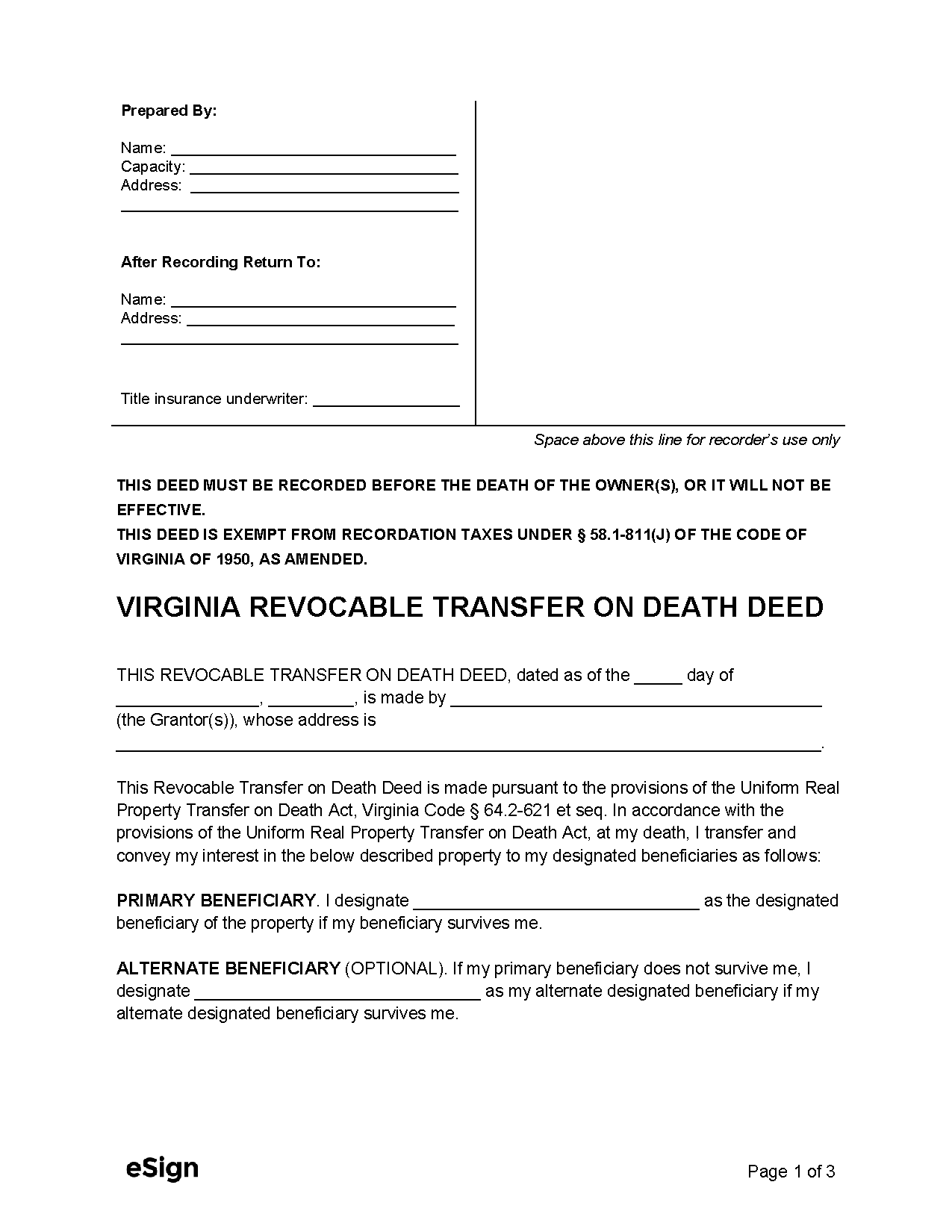

Transfer On Death Deed Template – Source old.sermitsiaq.ag

Transfer-on-death deeds have been around for centuries. The first transfer-on-death deed was recorded in England in the 16th century. In the United States, transfer-on-death deeds were first recognized by the Uniform Probate Code in 1969.

There are a number of myths about transfer-on-death deeds. One myth is that transfer-on-death deeds are only for people who are terminally ill. This is not true. Transfer-on-death deeds can be used by anyone who wants to ensure that their property is transferred to their loved ones after they die.

Hidden Secrets of Transfer-on-Death Deeds

![Maine Deed Forms & Templates (Free) [Word, PDF, ODT] Maine Deed Forms & Templates (Free) [Word, PDF, ODT]](https://templates.legal/wp-content/uploads/2021/11/Maine-Deed-of-Trust-Templates.Legal_.jpg)

Maine Deed Forms & Templates (Free) [Word, PDF, ODT] – Source templates.legal

There are a number of hidden secrets about transfer-on-death deeds that you may not know. One secret is that transfer-on-death deeds can be used to transfer any type of property, not just real estate. You can use a transfer-on-death deed to transfer stocks, bonds, bank accounts, and other types of property.

Another secret is that transfer-on-death deeds can be used to create a trust. A trust is a legal entity that can own property. You can use a transfer-on-death deed to transfer property to a trust, and then name your beneficiaries as the beneficiaries of the trust.

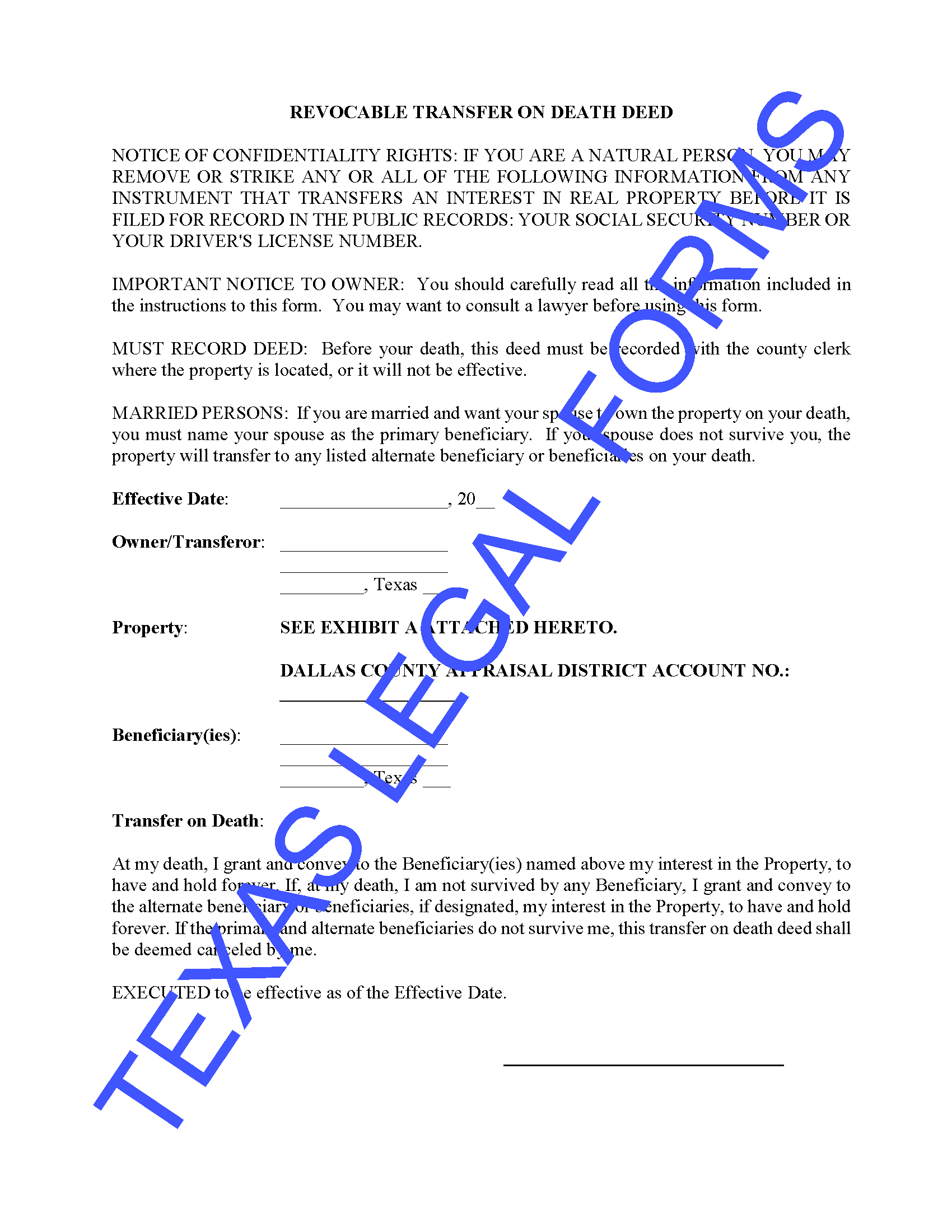

Recommendations for Transfer-on-Death Deeds

Transfer On Death (TOD) Deed: Naming Beneficiaries And, 42% OFF – Source www.micoope.com.gt

If you are considering using a transfer-on-death deed, there are a few things you should keep in mind. First, you should make sure that you understand the terms of the deed. Second, you should make sure that the deed is properly executed and recorded. Third, you should keep the deed in a safe place.

Transfer-on-death deeds can be a valuable estate planning tool. They can help you ensure that your property is transferred to your loved ones according to your wishes. If you are considering using a transfer-on-death deed, be sure to talk to an attorney to learn more about your options.

Benefits of Transfer-on-Death Deeds

New Mexico Deed Transfer Form Free Printable – Printable Forms Free Online – Source printableformsfree.com

There are many benefits to using a transfer-on-death deed, including:

- Avoids probate

- Simplifies the transfer of property

- Protects your privacy

- Saves time and money

- Ensures that your property is transferred to your loved ones according to your wishes

Tips for Using Transfer-on-Death Deeds

![Indiana Deed Forms & Templates (Free) [Word, PDF, ODT] Indiana Deed Forms & Templates (Free) [Word, PDF, ODT]](https://templates.legal/wp-content/uploads/2021/11/Indiana-General-Warranty-Deed-Templates.Legal_.jpg)

Indiana Deed Forms & Templates (Free) [Word, PDF, ODT] – Source templates.legal

Here are a few tips for using transfer-on-death deeds:

- Make sure that you understand the terms of the deed before you sign it.

- Have the deed properly executed and recorded.

- Keep the deed in a safe place.

- Review your deed regularly to make sure that it still meets your needs.

Common Mistakes to Avoid

Quick Guide to California Transfer on Death Deeds | Snyder Law – Source www.snyderlawpc.com

Here are a few common mistakes to avoid when using transfer-on-death deeds:

- Not understanding the terms of the deed

- Not having the deed properly executed and recorded

- Losing the deed

- Not reviewing the deed regularly

Fun Facts about Transfer-on-Death Deeds

Ownership Agreement Template – Source mage02.technogym.com

Here are a few fun facts about transfer-on-death deeds:

- Transfer-on-death deeds have been around for centuries.

- Transfer-on-death deeds can be used to transfer any type of property.

- Transfer-on-death deeds can be used to create a trust.

- Transfer-on-death deeds are a valuable estate planning tool.

How to Create a Transfer-on-Death Deed

Cook County Transfer on Death Instrument Form | Illinois | Deeds.com – Source www.deeds.com

To create a transfer-on-death deed, you will need to:

- Obtain a transfer-on-death deed form from your county recorder’s office.

- Fill out the form and sign it in front of a notary public.

- Record the deed with the county recorder’s office.

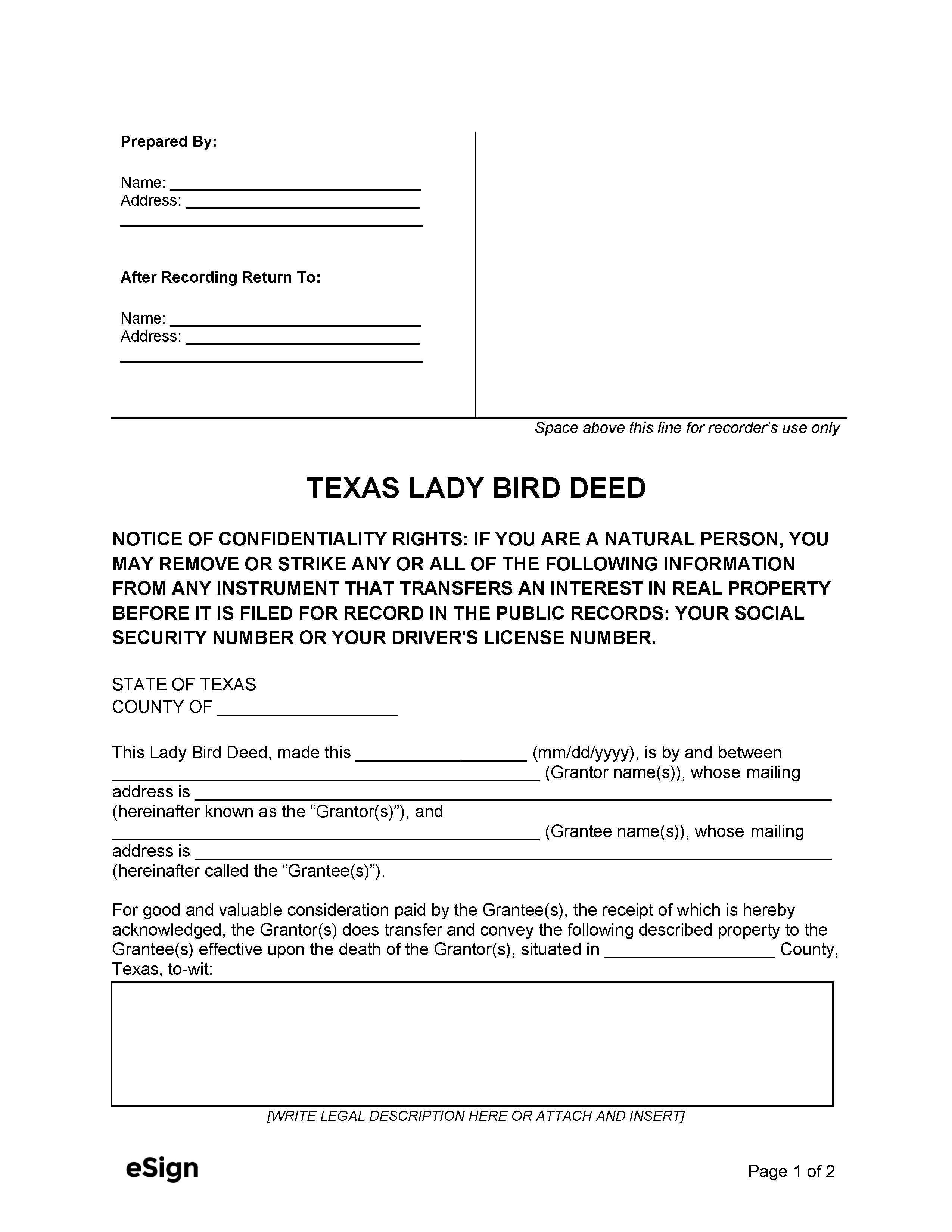

What if I Change My Mind?

Free Printable Lady Bird Deed Form Texas – Printable Forms Free Online – Source printableformsfree.com

If you change your mind about who you want to inherit your property, you can revoke your transfer-on-death deed by recording a new deed with the county recorder’s office.

Listicle of Transfer-on-Death Deeds

- Transfer-on-death deeds are a simple and effective way to ensure that your property is transferred to your loved ones after you die.

- Transfer-on-death deeds can be used to transfer any type of property, not just real estate.

- Transfer-on-death deeds can be used to create a trust.

- Transfer-on-death deeds are a valuable estate planning tool.

- Transfer-on-death deeds are easy to create and revoke.

Questions and Answers

Conclusion of Legally Transfer Property Ownership In Illinois: A Guide To Transfer-on-Death Deeds

Transfer-on-death deeds are a valuable estate planning tool that can help you ensure that your property is transferred to your loved ones according to your wishes. If you are considering using a transfer-on-death deed, be sure to talk to an attorney to learn more about your options.