Navigating inheritance laws for deceased homeowners can be a challenging time for families.

The Pain Points of Estate Resolution for Deceased Homeowners

Losing a loved one is difficult enough, but when there are property and financial matters to resolve, it can make the grieving process even more overwhelming. Without a clear understanding of inheritance laws and how they apply to real estate, family members can face unnecessary delays, disputes, and even financial losses.

Resolving Estate Ownership through Inheritance Laws

Inheritance laws provide a framework for distributing the assets of a deceased person to their heirs. When it comes to real estate, the laws vary from state to state. It’s essential to consult with an attorney who specializes in estate planning in your jurisdiction to ensure that the deceased’s wishes are respected and that the property is transferred smoothly to the rightful heirs.

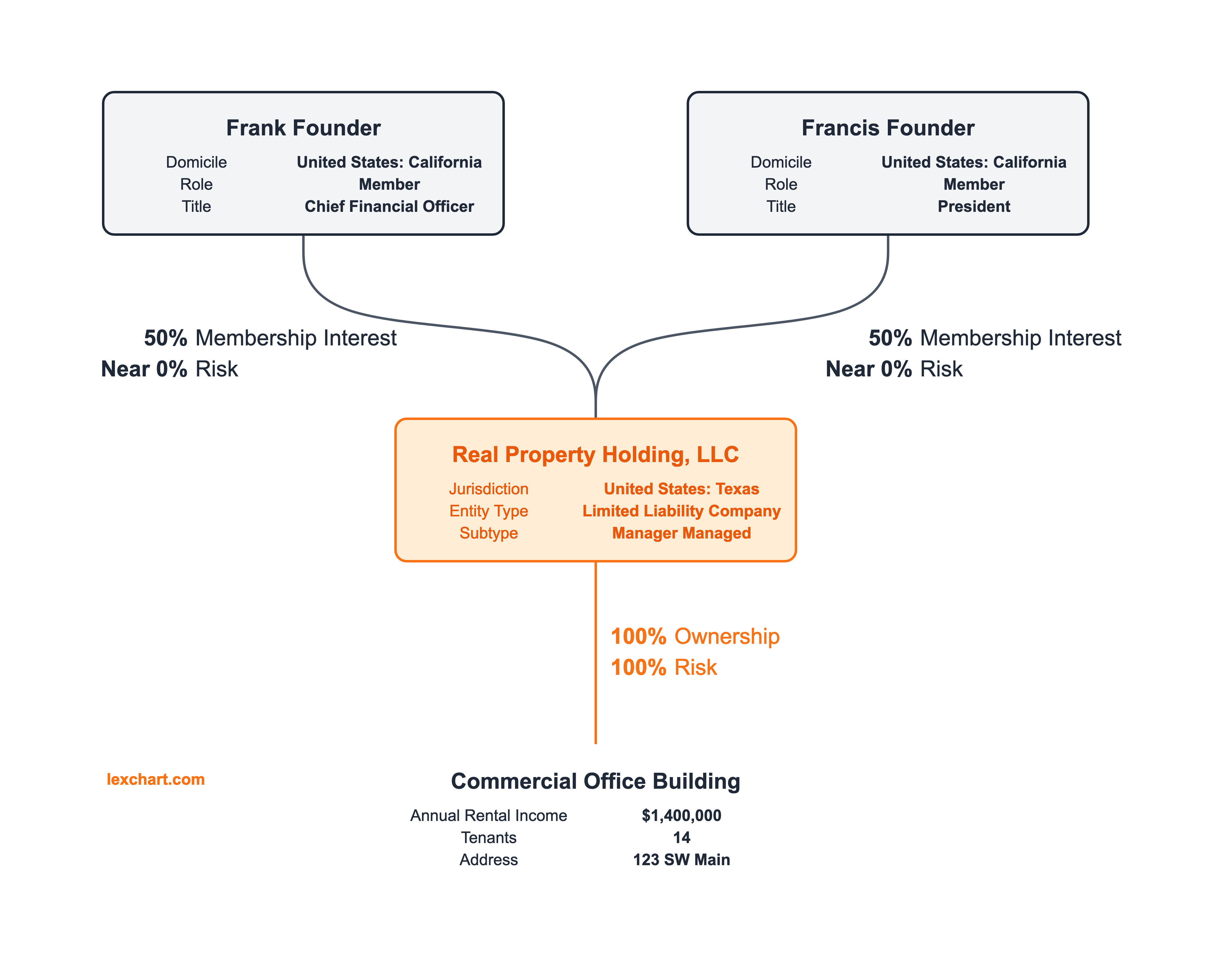

Free Org Chart Template for LLC for Real Estate Investment – Source lexchart.com

Resolve Estate Ownership: Understanding Inheritance Laws for Deceased Homeowners

Inheritance laws for deceased homeowners determine who inherits the property and how it is distributed. Factors such as the deceased’s will, the presence of a surviving spouse or children, and the laws of the state where the property is located will all play a role in determining the outcome.

In many cases, the deceased’s will specifies who will inherit the property, but if there is no will, state laws will govern the distribution. These laws typically give priority to surviving spouses, children, and then other relatives.

Muslim mother Inheritance share | Islamic Inheritance law – Source www.islamicinheritancelaw.com

History and Myths of Inheritance Laws for Deceased Homeowners

Inheritance laws have evolved over time, reflecting changing social norms and values. In the past, inheritance laws favored male heirs over female heirs, but this has changed in recent decades. Today, men and women have equal rights to inherit property.

One common myth about inheritance laws is that the oldest child automatically inherits the property. However, this is not true in most states. The distribution of property is typically determined by the deceased’s will or the laws of the state where the property is located.

Inheritance tax threshold frozen until 2026 – but why is IHT planning – Source wollens.co.uk

Hidden Secrets of Inheritance Laws for Deceased Homeowners

There are a few hidden secrets about inheritance laws that can surprise heirs. For example, in some states, a surviving spouse may have the right to a “family allowance” from the deceased’s estate, even if they are not specifically mentioned in the will.

Another hidden secret is that there may be creditors’ claims against the estate that can reduce the amount of property that is distributed to heirs. It’s important to be aware of these potential claims before making any decisions about how the property will be distributed.

Inheritance disputes – how mediation can resolve and reconcile — Civil – Source civilmediation.org

Recommendations for Resolving Estate Ownership through Inheritance Laws

If you are faced with the task of resolving estate ownership for a deceased homeowner, it’s important to follow these recommendations:

- Obtain a copy of the deceased’s will, if there is one.

- Consult with an attorney who specializes in estate planning.

- Identify all of the deceased’s assets and liabilities.

- File the necessary paperwork with the probate court.

- Distribute the property according to the deceased’s will or the laws of the state where the property is located.

BC Inheritance Laws (2023) | Estate Law in British Columbia – Source onyxlaw.ca

Inherited Property and Capital Gains Taxes

Inheriting property can have tax implications, particularly when it comes to capital gains taxes. When you inherit property, you receive a “stepped-up basis” in the property. This means that the cost basis of the property is adjusted to its fair market value as of the date of the death of the deceased homeowner.

This can have a significant impact on your capital gains tax liability. If you sell the property for more than the stepped-up basis, you will be liable for capital gains tax on the difference. However, if you sell the property for less than the stepped-up basis, you will not owe any capital gains tax.

Contesting a Deceased Estate – What to Do if You Have Been Left Out of – Source www.beger.com.au

Tips for Resolving Estate Ownership through Inheritance Laws

Here are some tips for resolving estate ownership through inheritance laws:

- Be organized and keep track of all important documents.

- Communicate with other heirs and beneficiaries.

- Be patient and understanding. The process of resolving estate ownership can take time.

- Don’t be afraid to ask for help from an attorney or other professionals.

LLC vs Estate of Deceased Individual | What is the Difference? – Tax ID – Source irs.zoomfilings.com

Inheritance Laws and Jointly Owned Property

If the deceased homeowner owned property jointly with another person, the laws of the state where the property is located will determine how the property is distributed. In most cases, the surviving joint owner will automatically inherit the property.

However, there are some exceptions to this rule. For example, if the deceased homeowner was married and the property was owned jointly with their spouse, the surviving spouse may have the right to a “homestead exemption.” This exemption allows the surviving spouse to continue living in the property, even if the deceased homeowner’s will states otherwise.

Estate Taxes in Europe | Estate, Inheritance, Gift Taxes | Tax Foundation – Source taxfoundation.org

Fun Facts about Inheritance Laws for Deceased Homeowners

Here are some fun facts about inheritance laws for deceased homeowners:

- In some states, a pet can inherit property.

- In England, the law of primogeniture used to give all of the deceased homeowner’s property to the oldest son.

- In some countries, the government can inherit property if there are no heirs.

Арешт майна третіх осіб у кримінальному провадженні – LexInform – Source lexinform.com.ua

How to Avoid Probate When Resolving Estate Ownership

Probate is the legal process of administering a deceased person’s estate. It can be a time-consuming and expensive process. There are a few ways to avoid probate, such as:

- Creating a living trust.

- Using joint ownership.

- Making gifts before death.

Property Ownership & Inheritance Rights of Women in India | Women of – Source www.pinterest.com

What if You Contest an Inheritance?

If you believe that you have been wrongfully disinherited, you may be able to contest the will. However, it is important to note that contesting a will is a difficult and expensive process. You should speak with an attorney to discuss your options before making any decisions.

Listicle of Resolve Estate Ownership: Inheritance Laws for Deceased Homeowners

- Obtain a copy of the deceased’s will, if there is one.

- Consult with an attorney who specializes in estate planning.

- Identify all of the deceased’s assets and liabilities.

- File the necessary paperwork with the probate court.

- Distribute the property according to the deceased’s will or the laws of the state where the property is located.

Question and Answer about Resolve Estate Ownership: Inheritance Laws for Deceased Homeowners

Q: Who inherits property when there is no will?

A: In most states, the property will pass to the deceased’s surviving spouse, children, and then other relatives, according to the laws of intestacy.

Q: Can I contest a will?

A: Yes, you may be able to contest a will if you believe that you have been wrongfully disinherited. However, contesting a will is a difficult and expensive process.

Q: How can I avoid probate?

A: There are a few ways to avoid probate, such as creating a living trust, using joint ownership, and making gifts before death.

Q: What is a “stepped-up basis” in property?

A: A “stepped-up basis” in property is a tax advantage that allows you to inherit property at its fair market value as of the date of the death of the deceased homeowner.

Conclusion of Resolve Estate Ownership: Inheritance Laws for Deceased Homeowners

Resolving estate ownership for a deceased homeowner can be a complicated process, but it is important to be aware of your rights and responsibilities as an heir or beneficiary. By following the advice in this article, you can help ensure that the deceased’s wishes are respected and that the property is distributed smoothly and efficiently.