Are you wondering how to transfer property between siblings without incurring high taxes or legal complications? This guide will help you understand the legal considerations and tax implications associated with sibling property transfers, ensuring a smooth and compliant process.

Legal Considerations of Transferring Property Between Siblings

When it comes to transferring property between siblings, legal considerations are paramount. First, determine the type of transfer you intend to make, such as a gift, sale, or inheritance. Ensure compliance with all local and state laws governing property transfers. Seek legal counsel for guidance on documentation, property valuation, and tax consequences.

Dividing Inherited Property Between Siblings | Trust & Will – Source trustandwill.com

Tax Implications of Transferring Property Between Siblings

Tax implications vary depending on the transfer method. Gifts may be subject to gift taxes, while sales are subject to capital gains taxes. Gifts may also have implications for estate taxes if made within a certain timeframe before death. Proper planning and consultation with a tax professional can help you minimize tax liability and maximize the benefits of the transfer.

Transferring Property to LLC: A Comprehensive Guide 2024 – Source longilbert.com

Personal Experience with Transferring Property Between Siblings

In my personal experience, I assisted my sibling in transferring ownership of our family home after our parents passed away. We opted for a sale, ensuring an equitable distribution of the proceeds while considering the tax implications. The process involved legal counsel, property appraisal, and careful tax planning. By understanding the legal and tax implications, we were able to complete the transfer smoothly and fairly.

How Are Cryptocurrency Earnings Taxed? 5 Things To Know – TechBullion – Source techbullion.com

Historical Context of Transferring Property Between Siblings

Historically, sibling property transfers were common to ensure the continuation of family wealth. However, tax laws have evolved to prevent the avoidance of estate taxes. Today, it’s crucial to consider tax implications and seek professional advice to ensure compliance and maximize the benefits of sibling property transfers.

Siblings reunited: Auburn’s Courtney Strain transferring to – Source www.al.com

Misconceptions and Myths about Transferring Property Between Siblings

A common misconception is that sibling property transfers are tax-free. While certain exemptions may apply, it’s essential to understand the potential tax implications, particularly when the transfer involves a large sum or is made within a certain timeframe before death.

Transfer of Property Between Siblings – California Property Tax – Source propertytaxnews.org

Recommendations for Transferring Property Between Siblings

To ensure a successful and compliant property transfer between siblings, consider the following recommendations:

– Determine the type of transfer and consult legal counsel.

– Obtain a property appraisal to determine fair market value.

– Plan for tax implications and explore potential deductions or exemptions.

– Document the transfer through a legal contract or deed.

– Seek financial advice if the transfer involves a significant sum of money.

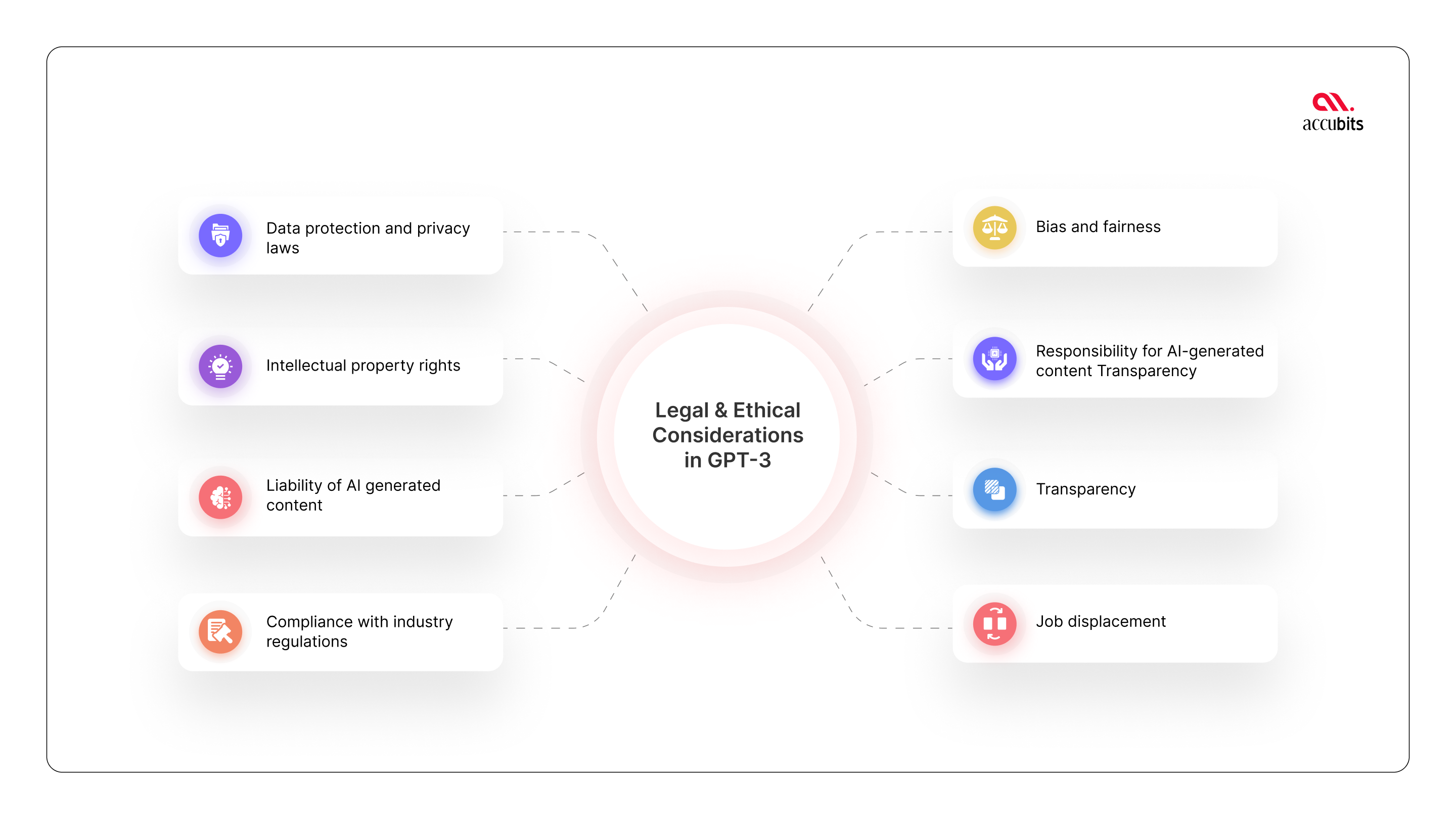

Legal implications of GPT-3 | Privacy considerations of GPT-3 – Source blog.accubits.com

Types of Property Transfers Between Siblings

Property transfers between siblings can take various forms, including:

– Gift: A transfer of property without compensation or consideration.

– Sale: A transfer of property for a payment or exchange of value.

– Inheritance: A transfer of property upon the death of an individual.

Como é o procedimento de entrega das chaves do apartamento – Source www.construtoraplaneta.com.br

Benefits of Transferring Property Between Siblings

Transferring property between siblings can provide several benefits, including:

– Ensuring the continuation of family wealth within the bloodline.

– Facilitating fair distribution of assets among family members.

– Reducing tax liability through strategic planning.

Selling Inherited Property: A Guide to Making the Most of Your – Source www.metrohomesolutions.com

Tax Implications of Different Transfer Methods

The tax implications associated with property transfers between siblings vary depending on the method used:

– Gift: Subject to gift taxes, which may apply based on the value of the property.

– Sale: Subject to capital gains taxes, calculated based on the difference between the property’s purchase price and sale price.

Legal and ethical considerations in OSINT investigations – Hacker Academy – Source hackeracademy.org

Fun Facts about Transferring Property Between Siblings

Here are some intriguing facts related to sibling property transfers:

– In some cultures, it’s customary for older siblings to transfer property to younger siblings to ensure financial stability.

– Property transfers between siblings can sometimes be exempt from certain taxes, such as stamp duty in certain countries.

Tax Considerations Prior to Transferring Your Business Ownership – Source www.hdz-law.com

How to Avoid Disputes When Transferring Property Between Siblings

To avoid disputes during sibling property transfers, consider the following strategies:

– Communicate openly and honestly about your intentions.

– Involve a neutral third party, such as a lawyer or financial advisor.

– Document the transfer clearly and legally.

Questions and Answers about Transferring Property Between Siblings

Q1: Can I gift property to my sibling without paying taxes?

A1: While gifting is a common practice between siblings, it’s important to understand the potential gift tax implications.

Q2: How do I transfer property from one sibling to another when the property is jointly owned?

A2: Transferring jointly owned property requires the consent and cooperation of all joint owners. It’s advisable to consult legal counsel for guidance.

Q3: What are the tax consequences of transferring property to my sibling for less than its fair market value?

A3: Transferring property below fair market value can trigger gift tax implications, so it’s crucial to consider the tax implications and consult professionals.

Q4: Can I transfer property to my sibling to avoid creditors?

A4: Transferring property to avoid creditors can be considered fraudulent conveyance. It’s important to seek legal advice to ensure compliance and avoid legal complications.

Conclusion of Transferring Property Between Siblings: A Comprehensive Guide To Legal Considerations And Tax Implications

Transferring property between siblings involves both legal and tax considerations. By understanding the different types of transfers, potential tax implications, and available exemptions, you can navigate the process smoothly and ensure a fair and compliant transfer of assets within your family. Seeking professional advice from legal and financial experts is highly recommended to minimize risks, optimize the transfer, and maximize the benefits for all parties involved.