Are you struggling to make sense of the complex market dynamics that influence stock valuations? Unraveling the intricacies of FORW stock valuations can be a daunting task, but with the right strategies, you can gain a deeper understanding and make informed investment decisions.

Navigating the stock market often requires deciphering the factors that drive company valuations. The challenge lies in understanding how market conditions, industry trends, and company-specific metrics interact to influence stock prices. FORW stocks, in particular, present unique challenges due to their forward-looking nature.

Decoding The Market Dynamics: Unraveling FORW Stock Valuations And Strategies

Unraveling FORW stock valuations and strategies involves a comprehensive approach that considers both qualitative and quantitative factors. Qualitative factors, such as market sentiment and industry outlook, can impact investor confidence and influence stock prices. Quantitative factors, such as financial ratios and earnings forecasts, provide insights into a company’s financial health and growth potential.

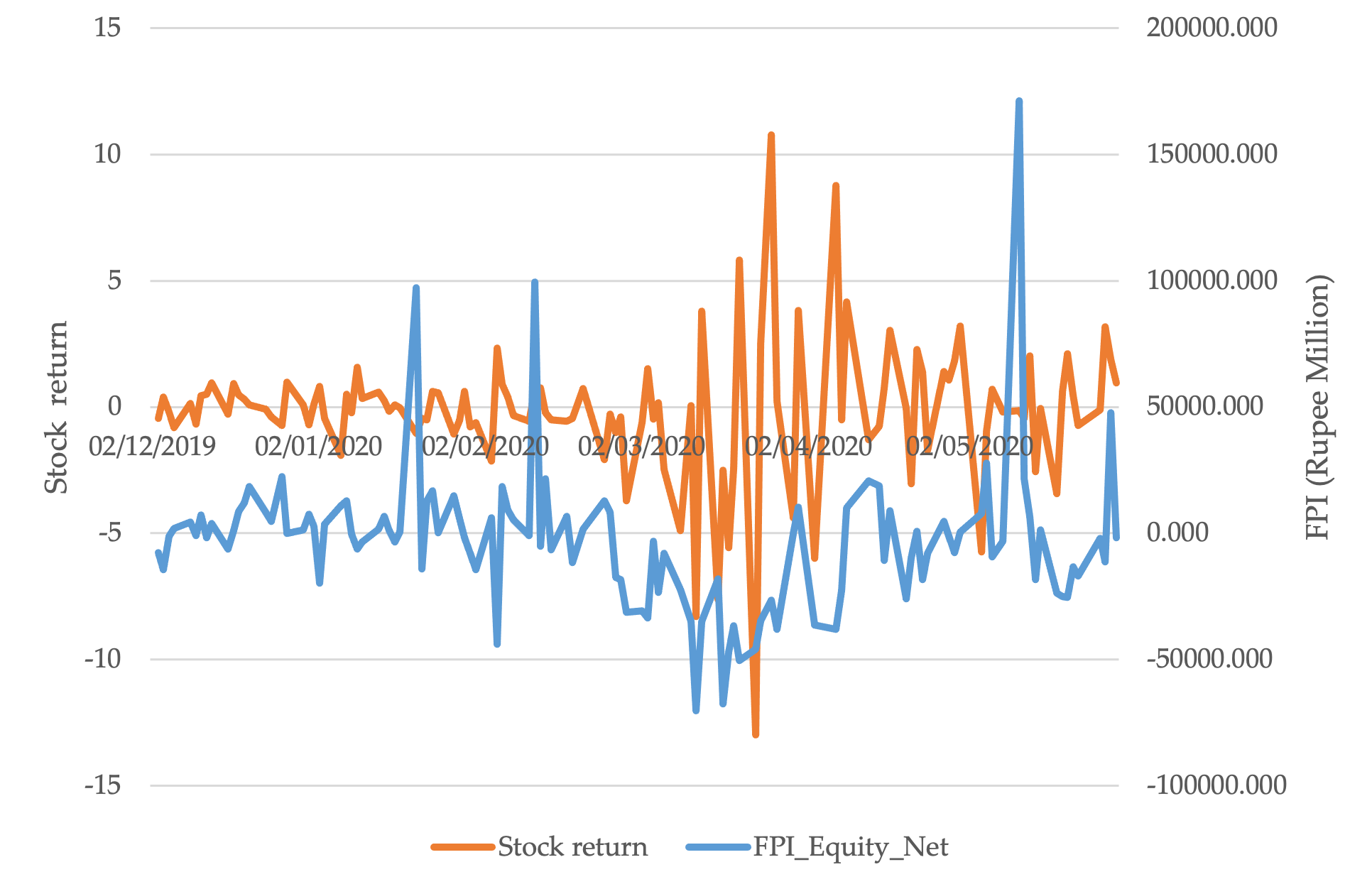

Dynamics of Foreign Portfolio Investment and Stock Market Returns – Source a-e-l.scholasticahq.com

A Deeper Dive into Decoding The Market Dynamics: Unraveling FORW Stock Valuations And Strategies

FORW stocks represent companies that are expected to experience significant growth in the future. Accurately valuing these stocks requires projecting future earnings and cash flows, which can be challenging. Analysts employ various valuation methods, such as discounted cash flow analysis and comparable company analysis, to assess the potential value of FORW stocks.

Decoding the market craziness with data | Wright Blogs – Source www.wrightresearch.in

History and Myths of Decoding The Market Dynamics: Unraveling FORW Stock Valuations And Strategies

The history of stock valuation is filled with myths and misconceptions. One common myth is that stock prices always follow a rational pattern. However, market dynamics can be unpredictable and influenced by irrational behavior. Understanding the historical context and debunking these myths is crucial for informed investment decisions.

36+ what type of interest is a mortgage – HuzaifahPavel – Source huzaifahpavel.blogspot.com

Unveiling the Hidden Secrets of Decoding The Market Dynamics: Unraveling FORW Stock Valuations And Strategies

Unlocking the hidden secrets of FORW stock valuations involves analyzing key financial metrics and identifying undervalued opportunities. By carefully assessing factors such as price-to-earnings ratio, price-to-sales ratio, and debt-to-equity ratio, investors can uncover companies with strong growth potential and favorable valuations.

Unraveling the Multifamily Market: Trends & Strategies for 2024 – REEP – Source reepequity.com

Recommended Strategies for Decoding The Market Dynamics: Unraveling FORW Stock Valuations And Strategies

Successfully navigating the FORW stock market requires a combination of strategies. Diversification across multiple stocks and asset classes helps mitigate risk. Additionally, staying informed about market news and company updates is essential for making timely investment decisions. Seeking professional advice from financial advisors can also provide valuable insights and guidance.

Differentiating Bank Valuations and Market Valuations – Source ratebuster.com.au

FORW Stock Valuations: A Closer Examination

FORW stock valuations are complex and impacted by various factors, including company fundamentals, industry trends, and economic conditions. By understanding the drivers of stock prices, investors can make informed decisions about when to buy, sell, or hold FORW stocks.

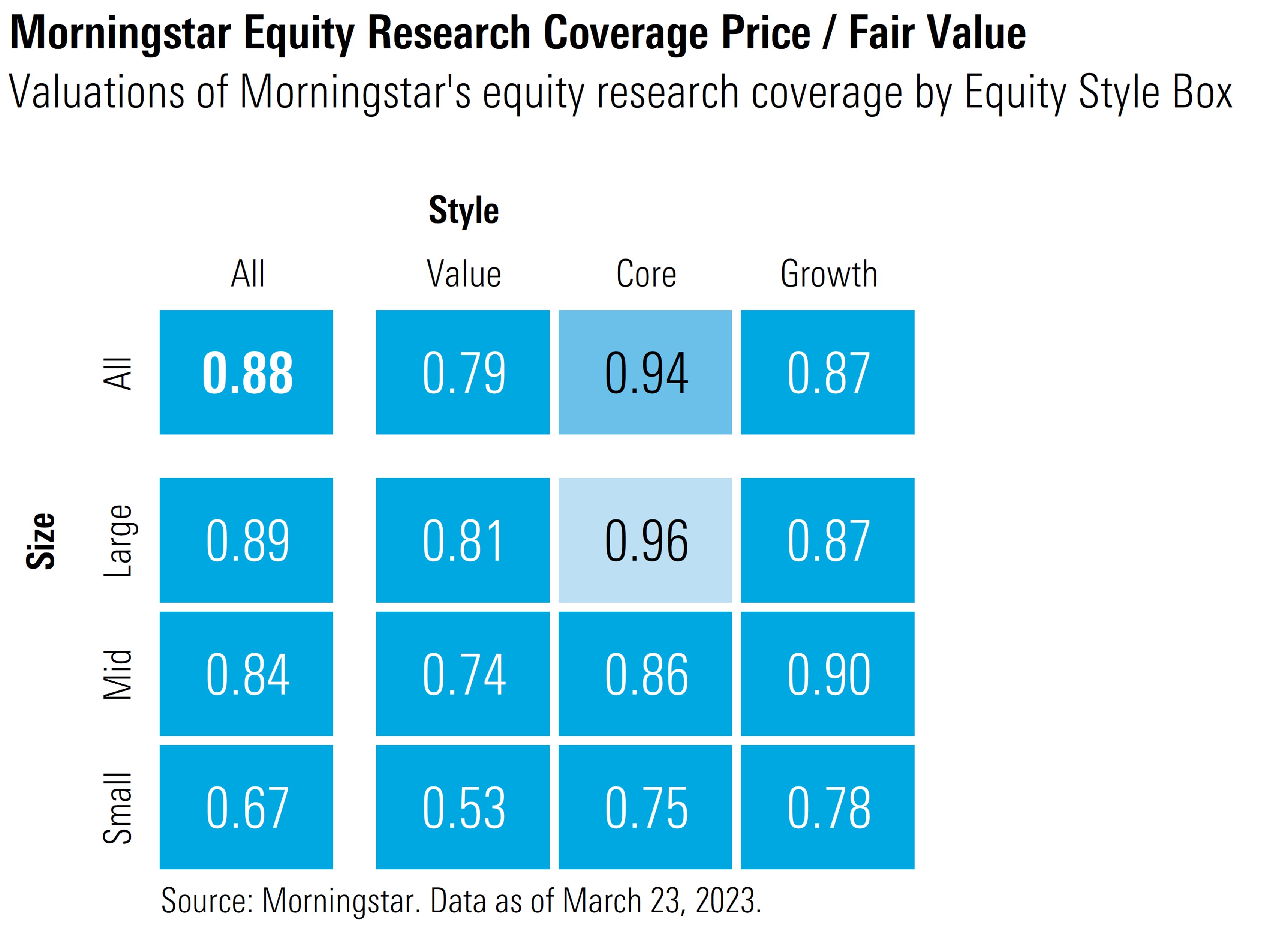

Second-Quarter 2023 Stock Market Outlook: Undervalued, but a Rough Road – Source www.morningstar.com

Tips for Decoding The Market Dynamics: Unraveling FORW Stock Valuations And Strategies

To enhance your understanding of FORW stock valuations, consider the following tips:

- Focus on long-term growth potential rather than short-term fluctuations.

- Conduct thorough research on company financials and industry dynamics.

- Utilize valuation tools and resources to assess stock values.

Decoding the Dynamics: Unraveling the Factors Shaping Hair Transplant – Source clinicdermatech.com

Key Considerations for FORW Stock Valuations

When evaluating FORW stocks, consider these key factors:

- Earnings growth projections

- Market share and competitive landscape

- Management team and execution capability

Valuation | Business valuation, Business management, Financial management – Source www.pinterest.com

Fun Facts about Decoding The Market Dynamics: Unraveling FORW Stock Valuations And Strategies

The world of FORW stock valuations is filled with intriguing facts. Did you know that:

- FORW stocks often have higher volatility than established companies.

- Historical stock prices can provide valuable insights for future valuations.

- Artificial intelligence is playing an increasing role in stock valuation.

Unraveling Dynamics in Mediation – Uitgeverij de Brouwerij – Source www.uitgeverijdebrouwerij.nl

How to Decode The Market Dynamics: Unraveling FORW Stock Valuations And Strategies

To decode the market dynamics and unravel FORW stock valuations, follow these steps:

- Develop a deep understanding of financial analysis.

- Stay abreast of market news and company updates.

- Utilize valuation tools and consult with financial experts.

Unraveling the Multifamily Market: Trends & Strategies for 2024 – REEP – Source reepequity.com

What if Decoding The Market Dynamics: Unraveling FORW Stock Valuations And Strategies Fails?

While understanding FORW stock valuations is crucial, it’s essential to recognize the inherent uncertainty of the stock market. Even with careful analysis, stock prices can fluctuate significantly. Therefore, it’s vital to manage risk, diversify your portfolio, and invest with a long-term perspective.

Listicle of Dos and Don’ts for Decoding The Market Dynamics: Unraveling FORW Stock Valuations And Strategies

To help you navigate FORW stock valuations, consider the following dos and don’ts:

- Do: Conduct thorough research.

- Don’t: Rely solely on historical data.

- Do: Seek professional advice when needed.

- Don’t: Invest more than you can afford to lose.

Question and Answer about Decoding The Market Dynamics: Unraveling FORW Stock Valuations And Strategies

Conclusion of Decoding The Market Dynamics: Unraveling FORW Stock Valuations And Strategies

Understanding the market dynamics and unraveling FORW stock valuations requires a combination of knowledge, analysis, and risk management. By embracing these principles, investors can navigate the complexities of the stock market and make informed investment decisions.