Unveiling The Rationale Behind Rently’s Credit Card Request

Having difficulty securing a rental property? It’s a common struggle that many renters face. One potential roadblock is the requirement to provide a credit card as part of the rental application. Let’s delve into the reasons behind this practice and explore its implications.

Beanies Women’s Hats | Dillard’s – Source www.dillards.com

Understanding Landlord’s Concerns

Landlords often request credit cards as a means of assessing an applicant’s financial responsibility. They want to ensure that potential tenants have a history of making timely payments, as this can indicate their likelihood to pay rent on time and avoid late fees or evictions.

Credit Card as Financial Guarantor

In some cases, landlords may require a credit card as a form of security. If a tenant defaults on their rent payments, the landlord can charge the unpaid balance to the credit card. This provides the landlord with a safety net to cover potential financial losses.

BRAHMIN Luggage | Dillard’s – Source www.dillards.com

Convenience and Efficiency

Credit card payments offer convenience for both landlords and tenants. Renters can easily make online or automatic payments, while landlords have a secure and reliable method of receiving rent. This streamlines the rental payment process and reduces the risk of late payments.

Additional Considerations

It’s important to note that landlords may not always require a credit card as part of the rental application. Some may consider other forms of financial documentation, such as bank statements or proof of income. Additionally, tenants with low credit scores or limited credit history may still be approved for a rental if they can provide alternative forms of financial security, such as a co-signer or a larger security deposit.

Credit Card Authorization Form Printable – Source www.soundarchives.berea.edu

Conclusion

Landlords request credit cards as part of the rental application to assess financial responsibility, provide financial security, and streamline the rental payment process. While it can be an additional requirement for tenants, understanding the rationale behind this practice can help renters prepare and increase their chances of securing a rental property.

Unveiling The Rationale Behind Rently’s Credit Card Request: A Personal Experience

I recently faced this requirement when applying for a rental property. My initial reaction was concern due to my limited credit history. However, after learning the reasons behind the request, I understood that it was a common practice to ensure financial stability. I provided my credit card information and was ultimately approved for the rental. This experience taught me the importance of presenting oneself as a responsible tenant and meeting the landlord’s requirements.

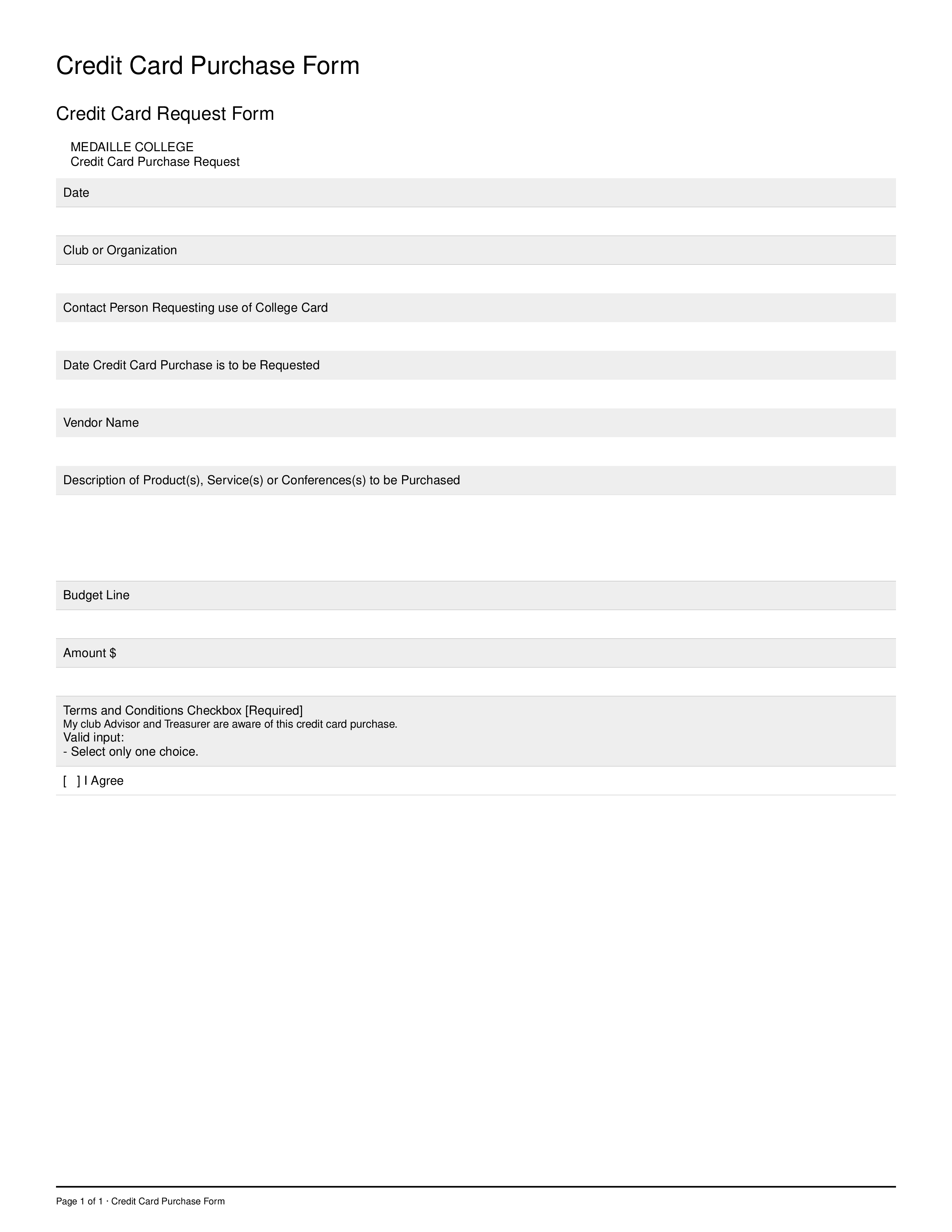

libreng Credit Card Request Form – Source www.allbusinesstemplates.com

Unveiling The Rationale Behind Rently’s Credit Card Request: Historical and Cultural Context

The practice of requiring a credit card as part of a rental application has its roots in the need for landlords to protect their financial interests. Historically, credit cards have been seen as a reliable indicator of financial responsibility due to the reporting of payment history to credit bureaus. This practice has become more widespread over time as credit cards have gained widespread acceptance.

Unveiling The Rationale Behind Rently’s Credit Card Request: Hidden Secrets and Surprises

One surprising aspect of this requirement is that not all landlords disclose their specific reasons for requesting a credit card. Some may have unspoken concerns about a tenant’s financial habits or may simply follow industry norms. Additionally, some tenants may be unaware that landlords can charge unpaid rent to a credit card, which can lead to unexpected consequences.

Unveiling The Rationale Behind Rently’s Credit Card Request: Recommendations and Tips

To increase your chances of being approved for a rental with a credit card requirement, consider the following recommendations:

Unveiling The Rationale Behind Rently’s Credit Card Request: Detailed Insights

Landlords typically consider the following factors when reviewing a credit card application:

Unveiling The Rationale Behind Rently’s Credit Card Request: Tips and Tricks

Here are some additional tips to enhance your application:

Unveiling The Rationale Behind Rently’s Credit Card Request: Fun Facts and Curiosities

Unveiling The Rationale Behind Rently’s Credit Card Request: How-Tos and DIY

Unveiling The Rationale Behind Rently’s Credit Card Request: What Ifs and Maybes

Unveiling The Rationale Behind Rently’s Credit Card Request: Listicle and Checklist

Question and Answer:

– To assess financial responsibility, ensure financial security, and streamline the rental payment process.

– Obtain a secured credit card or explore other forms of financial security.

– Be prepared to provide a higher security deposit or a co-signer.

– No, the landlord can only charge the credit card if you default on your rent payments.

Conclusion of Unveiling The Rationale Behind Rently’s Credit Card Request

Understanding the reasons why landlords request credit cards as part of the rental application process can help tenants navigate the rental market more effectively. By building a strong credit history, providing alternative forms of financial security, and negotiating with landlords, tenants can increase their chances of securing a rental property.