Are you looking for a trusted and reliable wealth management solution in Canada? Look no further! Here’s a comprehensive guide to the leading Canadian trust companies that can help you secure your financial future.

Alison Monk | Canaccord Genuity Wealth Management – Source www.canaccordgenuity.com

Understanding the Importance of Wealth Management

Managing wealth can be a daunting task, especially in today’s complex financial landscape. Trusted wealth management solutions offer personalized guidance, expert advice, and comprehensive services to help you navigate the complexities of wealth management. By partnering with a reputable trust company, you can address your financial challenges and achieve your long-term financial goals.

Trusted Wealth Management Solutions: The Key to Financial Security

Canadian trust companies are regulated and authorized to provide a wide range of wealth management services, including investment management, estate planning, tax planning, and more. By leveraging their expertise and experience, you can develop a tailored wealth management strategy that aligns with your unique financial needs and aspirations.

Essential Components of Trusted Wealth Management Solutions

At its core, trusted wealth management solutions are designed to provide comprehensive support for your financial well-being. These solutions typically encompass:

S1E8: Finding Unique Investment Opportunities with Daniel Zwirn from – Source podcasters.spotify.com

- Investment Management: Expert guidance on investment strategies, portfolio diversification, and risk management to maximize growth and minimize losses.

- Estate Planning: Comprehensive strategies to ensure the distribution of your assets according to your wishes, minimizing tax implications and preserving your legacy.

- Tax Planning: Strategic tax planning to optimize your tax liabilities and maximize the value of your wealth.

Best solution for Device management,cost management,workflow management – Source www.dynamicautomation.co.in

Personal Experience: Finding a Trusted Partner

Meet the Team | AAFMAA Wealth Management & Trust – Source aafmaatrust.com

My journey with wealth management began when I inherited a substantial amount of money. Overwhelmed and unsure how to handle it, I sought the guidance of a reputable trust company. Their personalized approach, expert advice, and tailored solutions gave me the confidence to navigate the complexities of wealth management and secure my financial future.

Trusted Wealth Management Solutions: A Historical Perspective

The history of trust companies in Canada dates back to the late 19th century, when they were established to provide safekeeping and management of assets for individuals and institutions. Over the years, trust companies have evolved to offer a comprehensive range of wealth management services, solidifying their position as a cornerstone of the Canadian financial landscape.

Unveiling the Hidden Secrets

The Trust Company Crosses .5 Billion Mark – Source www.prweb.com

Behind the scenes of every reputable trust company lies a diligent team of professionals who dedicate themselves to providing exceptional client service. They employ advanced technologies, adhere to strict regulatory standards, and embrace ethical practices to ensure the security and growth of your wealth.

Trusted Wealth Management Solutions: The Ultimate Recommendation

When it comes to choosing a trusted wealth management solution, it’s essential to conduct thorough research and assess the reputation and expertise of potential partners. Consider their investment performance, regulatory compliance, fee structure, and client testimonials to make an informed decision that aligns with your financial needs and goals.

Key Features of Trusted Wealth Management Solutions:

When evaluating trusted wealth management solutions, look for these key features:

Kamal Lidder An 18-Year Legacy of Unparalleled Excellence in Financial – Source www.culturezoneuk.com

- Personalized Advice: Tailored strategies that align with your unique financial situation and aspirations.

- Professional Expertise: Experienced and certified professionals who stay abreast of market trends and regulatory changes.

- Comprehensive Services: A full suite of wealth management services, including investment management, estate planning, and tax planning.

Tips for Choosing the Right Wealth Management Solution

To select the best wealth management solution for your needs, consider the following tips:

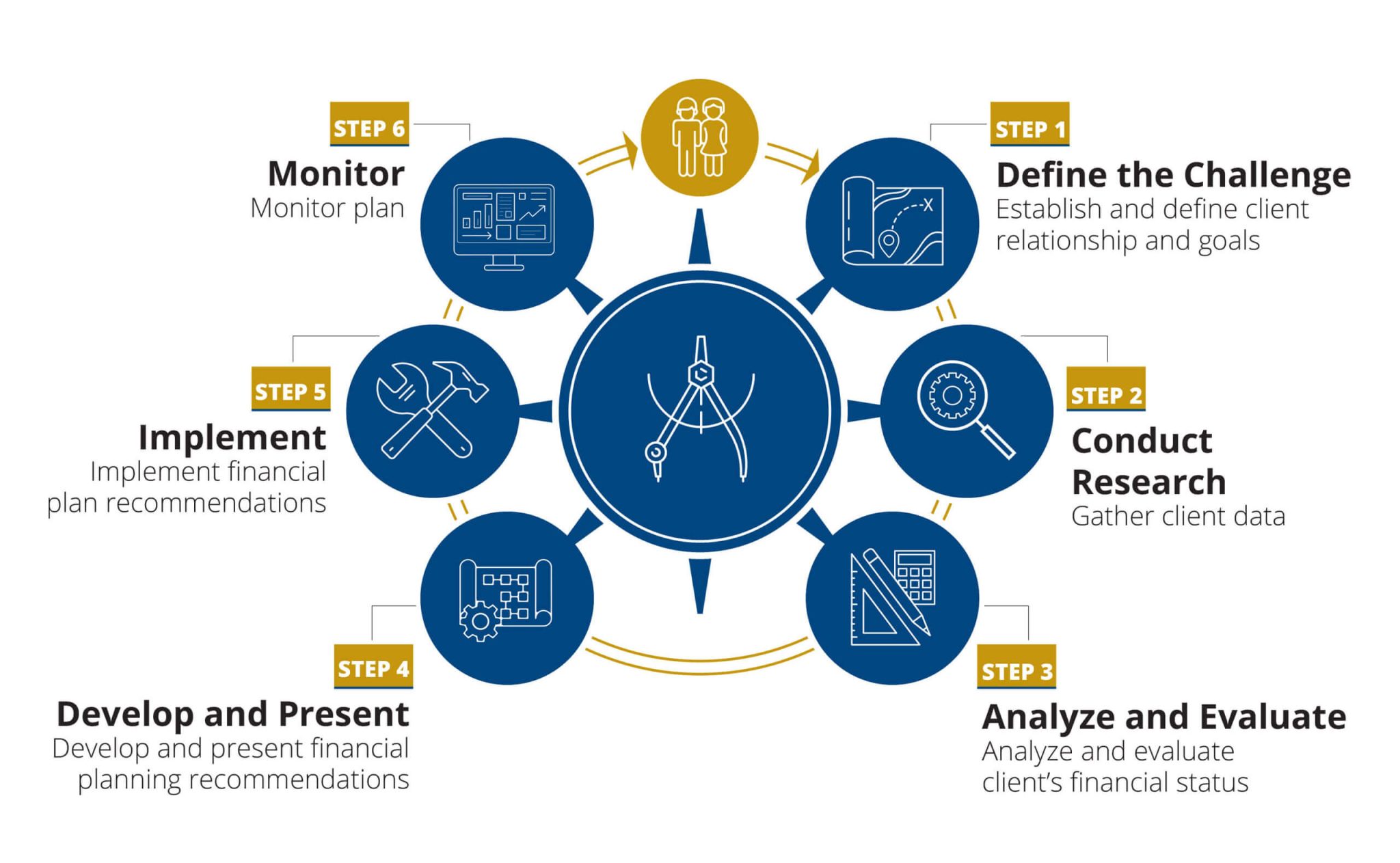

Financial Planning Process – Bollin Wealth Management – Source bollinwealth.com

- Define Your Needs: Clearly outline your financial goals, risk tolerance, and investment horizon.

- Research and Compare: Compare multiple trust companies, examining their track record, fees, and services offered.

- Personal Referrals: Seek recommendations from trusted individuals or financial advisors who have used wealth management services.

Additional Considerations for Trusted Wealth Management Solutions:

Beyond the core services, consider these additional factors when selecting a wealth management solution:

- Digital Accessibility: Look for companies that offer online platforms and mobile apps for convenient account management.

- Regulatory Compliance: Ensure that the trust company is regulated by recognized authorities and adheres to industry best practices.

- Fee Structure: Understand the fee structure and how it aligns with the value of services provided.

Fun Facts about Trusted Wealth Management Solutions

Meet the Team | AAFMAA Wealth Management & Trust – Source aafmaatrust.com

Here are some fun facts about trusted wealth management solutions:

- The first trust company in Canada was established in 1882.

- Trust companies manage over $3 trillion in assets in Canada.

- Many trust companies offer educational resources and seminars to empower clients with financial knowledge.

How to Choose a Trusted Wealth Management Solution

Choosing the right trusted wealth management solution is crucial for your financial well-being. Follow these steps to make an informed decision:

- Gather Information: Research different trust companies, read reviews, and compare their services.

- Schedule Consultations: Arrange meetings with multiple trust companies to discuss your needs and assess their expertise.

- Evaluate Credentials: Verify the credentials and experience of the wealth managers who will handle your account.

What If You Don’t Have a Trusted Wealth Management Solution?

)

Wealth Management for Business Owners – Source www.findex.com.au

Not having a trusted wealth management solution can hinder your financial growth and increase your exposure to risks. Consider the following consequences:

- Missed Investment Opportunities: You may miss out on potential growth opportunities due to a lack of professional guidance.

- Estate Planning Issues: Your estate may not be properly planned, leading to unnecessary taxes and disputes among heirs.

- Tax Inefficiencies: You may pay more taxes than necessary due to inadequate tax planning.

Listicle: Benefits of Trusted Wealth Management Solutions

In summary, here are the key benefits of partnering with a trusted wealth management solution:

- Personalized Advice: Tailored financial plans that meet your specific needs and goals.

- Professional Expertise: Access to experienced wealth managers who stay updated on market trends.

- Comprehensive Services: A full range of services to address all aspects of your financial well-being.

Questions and Answers about Trusted Wealth Management Solutions

- Q: What are the benefits of using a trust company for wealth management?

- A: Trust companies provide personalized advice, professional expertise, and a comprehensive range of services to help you manage your wealth effectively.

- Q: How do I choose the right trust company for my needs?

- A: Research different trust companies, schedule consultations, and evaluate their credentials and experience to find the best fit for your financial situation.

- Q: What services do trust companies typically offer?

- A: Trust companies typically offer investment management, estate planning, tax planning, and other related services to help you manage your wealth.

- Q: Is it expensive to use a trust company for wealth management?

- A: The cost of wealth management services varies depending on the complexity of your needs and the fees charged by the trust company.

![]()

Managed Portfolios | Wealth Management | Coronation – Source www.coronation.ng

Conclusion of Trusted Wealth Management Solutions: Leading Canadian Trust Companies

Partnering with a trusted wealth management solution in Canada provides a comprehensive and effective approach to managing your financial affairs. By entrusting your wealth to a reputable trust company, you gain access to personalized advice, expert guidance, and a tailored strategy that aligns with your unique financial goals and aspirations.