The new 2024 Commuter FSA limits offer a great opportunity to save money on transportation costs. But what exactly are these limits, and how can you take advantage of them? Keep reading to learn more about the 2024 Commuter FSA limits and how you can maximize your pre-tax savings on transportation.

The IRS Announces the Commuter Benefits Pre-Tax Limits for 2024 – Source edenredbenefits.com

Commuter FSAs: What Are They?

Commuter FSAs are employer-sponsored accounts that allow employees to set aside pre-tax dollars to pay for eligible commuting expenses, such as public transportation, vanpools, or parking. This can result in significant savings on transportation costs, as the money you contribute to your FSA is deducted from your paycheck before taxes are taken out.

Open enrollment for 2024 Health FSA to run from now to October 31, 2023 – Source ble-t.org

2024 Commuter FSA Limits

For 2024, the maximum amount that employees can contribute to a Commuter FSA is $3,000. This is an increase of $200 from the 2023 limit of $2,800. The monthly maximum contribution for 2024 is now $250.

Roth Limits 2024 Tsp – Jess Romola – Source kristiwnancy.pages.dev

How to Maximize Your 2024 Commuter FSA Savings

To maximize your pre-tax savings on transportation, it’s important to contribute as much as you can to your Commuter FSA. If you can afford to do so, contribute the maximum amount of $3,000. Even if you can only contribute a smaller amount, every dollar you contribute will save you money on taxes.

Vincere Tax – Understanding 2024 HSA Limits: Unlocking Potential Savings – Source www.vinceretax.com

Conclusion of 2024 Commuter FSA Limits: Maximize Pre-Tax Savings For Transportation

The 2024 Commuter FSA limits offer a great opportunity to save money on transportation costs. By contributing to a Commuter FSA, you can reduce your taxable income and save money on taxes. If you commute to work, be sure to take advantage of this valuable tax-saving benefit.

Personal Experience with Commuter FSA

I’ve been using a Commuter FSA for the past few years, and I’ve saved a significant amount of money on transportation costs. I contribute the maximum amount of $3,000 each year, and I use the money to pay for my monthly public transportation pass. This has saved me hundreds of dollars on taxes, and it’s made commuting to work much more affordable.

2024 FSA Deferral Limits – Benecon – Source benecon.com

What is a Commuter FSA?

A Commuter FSA is a flexible spending account that allows employees to set aside pre-tax dollars to pay for eligible commuting expenses. This can include public transportation, vanpools, parking, and biking. Commuter FSAs are offered by employers as a way to help employees save money on transportation costs.

Maximize Your Savings Exciting 401(k) Contribution Limits Boosts in – Source www.konahr.com

History and Myths of Commuter FSA

Commuter FSAs have been around for many years, but they have only recently become more popular. One of the reasons for this is that there are many myths and misconceptions about Commuter FSAs. For example, some people believe that Commuter FSAs are only available to employees who work in large cities. This is not true. Commuter FSAs are available to employees of all sizes of businesses, regardless of their location.

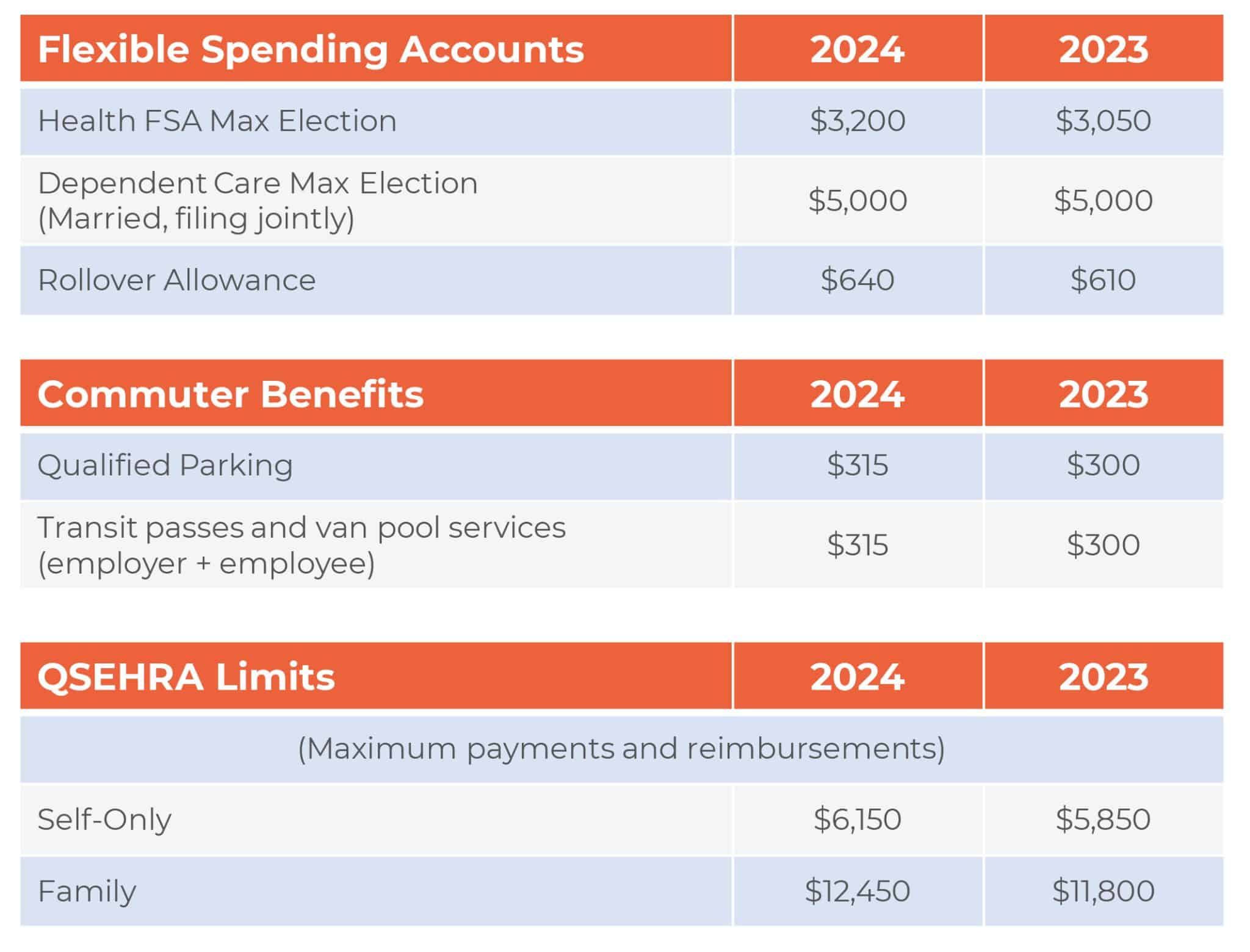

Just In: 2024 Benefit Limits – HRPro – Source www.hrpro.com

Hidden Secrets of Commuter FSA

There are many hidden secrets of Commuter FSAs that can help you save even more money. For example, did you know that you can use your Commuter FSA to pay for parking at work? Or that you can use your Commuter FSA to pay for vanpools? These are just a few of the many ways that you can use your Commuter FSA to save money on transportation costs.

Tabela Atualizado Irs 2023 Hsa Imagesee – vrogue.co – Source www.vrogue.co

Recommendation of Commuter FSA

If you commute to work, I highly recommend that you consider using a Commuter FSA. It’s a great way to save money on transportation costs and reduce your taxable income. Talk to your employer to see if they offer a Commuter FSA, and if they do, sign up today!

2024 Health FSA Limit Increased to ,200 – Source www.newfront.com

What are the benefits of using a Commuter FSA?

There are many benefits to using a Commuter FSA, including:

- Save money on transportation costs

- Reduce your taxable income

- Make commuting to work more affordable

Famis Income Limits 2024 – Lotta Diannne – Source betteannewjill.pages.dev

Tips for Using a Commuter FSA

Here are a few tips for using a Commuter FSA:

- Contribute as much as you can afford to.

- Use your Commuter FSA to pay for all eligible commuting expenses.

- Keep track of your receipts in case you are audited.

What are the eligibility requirements for a Commuter FSA?

To be eligible for a Commuter FSA, you must be an employee who commutes to work. You do not need to work in a large city to be eligible for a Commuter FSA. Commuter FSAs are available to employees of all sizes of businesses, regardless of their location.

Fun Facts of Commuter FSA

Here are a few fun facts about Commuter FSAs:

- Commuter FSAs have been around for many years, but they have only recently become more popular.

- There are many myths and misconceptions about Commuter FSAs.

- Commuter FSAs can be used to pay for a variety of eligible commuting expenses, including public transportation, vanpools, parking, and biking.

How to Use a Commuter FSA

To use a Commuter FSA, you will need to sign up with your employer. Once you are enrolled, you will need to decide how much you want to contribute to your FSA each pay period. You can contribute up to the maximum amount of $3,000 per year.

What If Scenarios of Commuter FSA

What if I don’t use all of the money in my Commuter FSA by the end of the year? If you do not use all of the money in your Commuter FSA by the end of the year, you will forfeit the remaining balance. This is why it is important to contribute only as much as you can afford to.

Listicle of Commuter FSA

Here is a listicle of the benefits of using a Commuter FSA:

- Save money on transportation costs

- Reduce your taxable income

- Make commuting to work more affordable

- Contribute up to the maximum amount of $3,000 per year

- Use your Commuter FSA to pay for all eligible commuting expenses

Question and Answer

Q: What is the maximum amount that I can contribute to a Commuter FSA in 2024?

A: The maximum amount that you can contribute to a Commuter FSA in 2024 is $3,000.

Q: What are some eligible commuting expenses that I can pay for with my Commuter FSA?

A: Some eligible commuting expenses that you can pay for with your Commuter FSA include public transportation, vanpools, parking, and biking.

Q: What happens if I don’t use all of the money in my Commuter FSA by the end of the year?

A: If you do not use all of the money in your Commuter FSA by the end of the year, you will forfeit the remaining balance.

Q: How can I sign up for a Commuter FSA?

A: To sign up for a Commuter FSA, you will need to contact your employer.