Identity theft is a serious crime that can have devastating consequences. In 2021, there were over 1.4 million reports of identity theft in the United States, with victims losing an average of $1,343 each.

If you’re worried about becoming a victim of identity theft, there are a number of steps you can take to protect yourself. One of the best ways to do this is to sign up for an identity theft protection service.

Identity theft protection services can help you monitor your credit and financial accounts for suspicious activity, and they can also provide you with identity restoration services if you become a victim of identity theft.

Allstate Identity Theft Protection: Protect Your Identity And Avoid Scams

Allstate Identity Theft Protection is a comprehensive identity theft protection service that can help you protect your identity and avoid scams. The service includes:

- Credit monitoring

- Financial account monitoring

- Identity restoration services

- Fraudulent Document Monitoring

- Identity Restoration Specialists

- Identity Theft Insurance

Allstate Identity Theft Protection is available for a monthly fee. The cost of the service varies depending on the level of coverage you choose.

Allstate Identity Protection Reviews 2024: Details, Pricing, & Features – Source www.g2.com

Personal Experience

I’ve been using Allstate Identity Theft Protection for several years now, and I’ve been very happy with the service. I’ve never had any problems with identity theft, but I know that I’m protected if I do.

One of the things I like most about Allstate Identity Theft Protection is that it’s very easy to use. I can access my account online or through the mobile app, and I can view my credit reports and financial account activity at any time.

![Identity Theft Protection Guide [Infographic] | Identity theft Identity Theft Protection Guide [Infographic] | Identity theft](https://i.pinimg.com/originals/aa/af/2a/aaaf2a5224663e2fc55bae97a586f969.png)

Identity Theft Protection Guide [Infographic] | Identity theft – Source www.pinterest.com

I also appreciate the fact that Allstate Identity Theft Protection offers a variety of identity restoration services. If I ever become a victim of identity theft, I know that I can count on Allstate to help me get my life back on track.

History and Myth

Identity theft has been around for centuries, but it has become increasingly common in recent years due to the rise of the internet. Identity thieves often use stolen information to open new credit accounts, make fraudulent purchases, or file for tax refunds.

There are many myths about identity theft, such as the belief that it only happens to wealthy people or that it’s impossible to prevent. However, the truth is that anyone can become a victim of identity theft, and there are a number of steps you can take to protect yourself.

Recent Articles About Identity Theft Protection Comparisons | All About – Source allaboutcookies.org

Hidden Secret

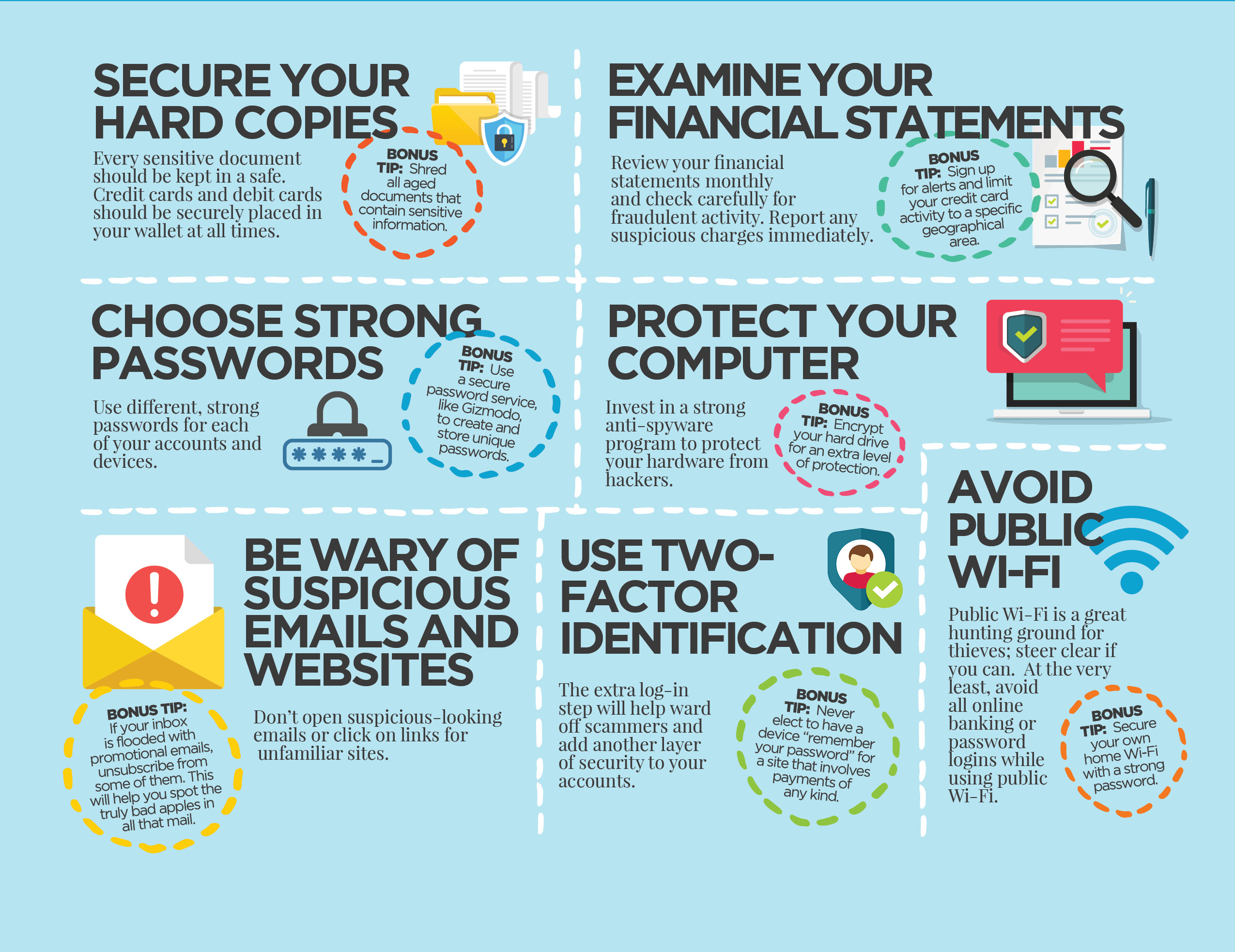

One of the best-kept secrets about identity theft is that it can be prevented. By taking simple steps such as shredding sensitive documents, using strong passwords, and being careful about what information you share online, you can significantly reduce your risk of becoming a victim.

If you’re concerned about identity theft, there are a number of resources available to help you. You can contact your local police department, the Federal Trade Commission, or a consumer advocacy group for more information.

Recommendation

If you’re looking for a comprehensive identity theft protection service, I highly recommend Allstate Identity Theft Protection. The service is affordable, easy to use, and it offers a variety of identity restoration services.

With Allstate Identity Theft Protection, you can rest assured that your identity is protected. Sign up for the service today and start protecting yourself from identity theft.

Your Guide to Identity Theft Protection – Source seacommblog.com

Conclusion

Identity theft is a serious crime that can have devastating consequences. However, by taking simple steps to protect your identity, you can significantly reduce your risk of becoming a victim.

If you’re concerned about identity theft, I encourage you to sign up for an identity theft protection service such as Allstate Identity Theft Protection. The service can help you monitor your credit and financial accounts for suspicious activity, and it can also provide you with identity restoration services if you become a victim of identity theft.

Tips

Here are a few tips to help you protect your identity and avoid scams:

- Shred sensitive documents before discarding them.

- Use strong passwords and change them regularly.

- Be careful about what information you share online.

- Don’t click on links in emails or text messages from unknown senders.

- Report any suspicious activity to your credit card company or bank immediately.

Muhi S. Majzoub on Twitter: “Our partnership with @Allstate Identity – Source twitter.com

Protect Your Children

Children are especially vulnerable to identity theft. Here are a few tips to help protect your children’s identities:

- Don’t share your child’s Social Security number or other personal information with anyone.

- Monitor your child’s credit reports regularly.

- Talk to your child about identity theft and how to protect themselves.

Fun Facts

Here are a few fun facts about identity theft:

- Identity theft is the fastest-growing crime in the United States.

- Identity thieves often use stolen information to open new credit accounts, make fraudulent purchases, or file for tax refunds.

- Identity theft can have a devastating impact on victims, both financially and emotionally.

Identity Theft Protection – Source ar.inspiredpencil.com

How To

Here are a few steps you can take to protect your identity and avoid scams:

- Sign up for an identity theft protection service.

- Freeze your credit reports.

- Monitor your credit and financial accounts for suspicious activity.

- Report any suspicious activity to your credit card company or bank immediately.

What If

What if you become a victim of identity theft? Here are a few steps you can take:

- Contact the police and file a report.

- Contact your credit card company and bank to report the fraud.

- Freeze your credit reports.

- Get a copy of your credit reports and review them for any unauthorized activity.

- Dispute any fraudulent charges.

Identity Protection – SBAM | Small Business Association of Michigan – Source www.sbam.org

Listicle

Here are a few things you can do to protect your identity and avoid scams:

- Sign up for an identity theft protection service.

- Freeze your credit reports.

- Monitor your credit and financial accounts for suspicious activity.

- Report any suspicious activity to your credit card company or bank immediately.

- Shred sensitive documents before discarding them.

- Use strong passwords and change them regularly.

- Be careful about what information you share online.

- Don’t click on links in emails or text messages from unknown senders.

- Talk to your children about identity theft and how to protect themselves.

Question and Answer

Q: What is identity theft?

A: Identity theft is a crime in which someone uses another person’s personal information to commit fraud.

Q: What are the signs of identity theft?

A: Some signs of identity theft include unauthorized charges on your credit card or bank account, unfamiliar accounts being opened in your name, or receiving calls or letters from collection agencies about debts you don’t recognize.

Allstate Logo Transparent PNG – Source mungfali.com

Q: What should I do if I become a victim of identity theft?

A: If you become a victim of identity theft, you should contact the police and file a report. You should also contact your credit card company and bank to report the fraud. Additionally, you should freeze your credit reports and get a copy of your credit reports to review them for any unauthorized activity.

Q: Can identity theft be prevented?

A: Yes, identity theft can be prevented. By taking simple steps such as shredding sensitive documents, using strong passwords, and being careful about what information you share online, you can significantly reduce your risk of becoming a victim.

Conclusion of Allstate Identity Theft Protection: Protect Your Identity And Avoid Scams

Identity theft is a serious crime that can have devastating consequences. However, by taking simple steps to protect your identity, you can significantly reduce your risk of becoming a victim.

If you’re concerned about identity theft, I encourage you to sign up for an identity theft protection service such as Allstate Identity Theft Protection. The service can help you monitor your credit and financial accounts for suspicious activity, and it can also provide you with identity restoration services if you become a victim of identity theft.