Navigating the healthcare landscape can be complex, and understanding the differences between HSAs and PPOs is crucial to making informed decisions about your healthcare coverage. Let’s dive in and uncover the key distinctions to help you choose the best plan for your needs.

Choosing the right health insurance plan can be like finding the perfect fit in a puzzle. With various options available, it’s essential to understand the unique characteristics of each plan to make the best decision for your specific needs and preferences. When it comes to HSAs and PPOs, both offer distinct advantages and considerations.

Health Savings Accounts (HSAs) and Preferred Provider Organizations (PPOs) represent two different approaches to healthcare coverage. HSAs combine high-deductible health plans with tax-advantaged savings accounts, while PPOs offer a more traditional network-based coverage model.

To choose the best plan for you, it’s essential to weigh the pros and cons of each option. HSAs offer tax benefits and the potential for long-term savings, while PPOs provide more comprehensive coverage and lower out-of-pocket costs in the short term. Consider your current health status, financial situation, and long-term healthcare goals to make an informed decision.

What is HSA?

HSA vs PPO: which is best for you? | Blog posts | Forma – Source www.joinforma.com

A Health Savings Account (HSA) is a tax-advantaged savings account that allows you to set aside money for qualified medical expenses. HSAs are paired with high-deductible health plans (HDHPs), which typically have lower monthly premiums but higher deductibles. Contributions to HSAs are made on a pre-tax basis, reducing your current taxable income. Withdrawals from HSAs are tax-free if used for qualified medical expenses. HSAs can be a suitable option for individuals who are healthy, have a stable income, and are willing to take on more financial risk.

What is PPO?

HMO vs. PPO: Differences, Similarities, and How to Choose – GoodRx – Source www.goodrx.com

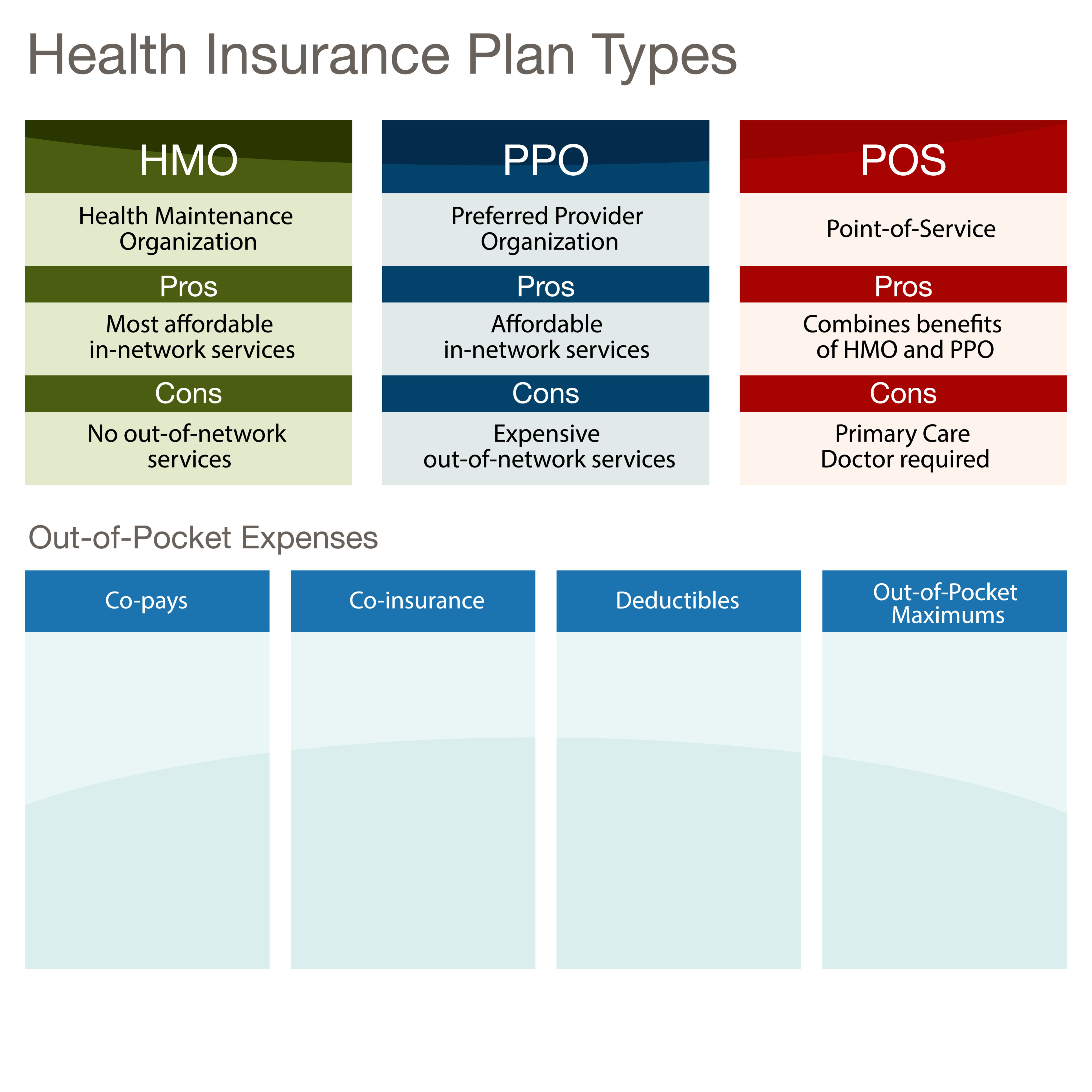

A Preferred Provider Organization (PPO) is a type of health insurance plan that offers a network of healthcare providers. PPOs allow you to choose providers within their network, while providing coverage for out-of-network providers at a higher cost. PPOs typically have lower deductibles and higher monthly premiums compared to HSAs. They are often a good choice for individuals who value flexibility and want to avoid high out-of-pocket expenses.

History and Myth of HSA vs PPO

HSA vs. FSA: What Are the Key Differences? | Business Certificate Online – Source businesscertificateonline.com.au

HSAs were introduced in 2003 as a way to encourage individuals to save for future healthcare expenses. PPOs have been around for decades and are a more established type of health insurance plan. Some common myths about HSAs include the belief that they are only for the wealthy or that they are too risky. In reality, HSAs can benefit individuals of all income levels, and the risks can be managed by choosing an HDHP with a low deductible.

Hidden Secret of HSA vs PPO

Whats a pos – inkgasw – Source inkgasw.weebly.com

One of the hidden secrets of HSAs is that the money you contribute grows tax-free. This means that your HSA can serve as a valuable long-term investment vehicle. Additionally, HSAs can be used to pay for a wide range of qualified medical expenses, including dental and vision expenses. PPOs, on the other hand, often have a wider network of providers, which can be beneficial for individuals who need to see specialists or who live in rural areas.

Recommendation of HSA vs PPO

HSA vs. FSA: What’s the difference and which should you choose – Source www.commoncentslifestyle.com

Deciding between an HSA and a PPO depends on your individual circumstances. If you are healthy, have a stable income, and are willing to take on more financial risk, an HSA can be a good option. HSAs offer tax benefits and the potential for long-term savings. If you value flexibility, have a lower income, or have ongoing medical expenses, a PPO may be a better choice. PPOs provide more comprehensive coverage and lower out-of-pocket costs in the short term.

Tips to Consider

Is HMO or PPO Better? | Types of HMO vs. PPO Insurance Plans – Source claritybenefitsolutions.com

When choosing between an HSA and a PPO, there are a number of factors to consider, including your age, health status, financial situation, and long-term healthcare goals. It’s important to carefully compare the benefits and drawbacks of each plan to make the best decision for your individual needs. Consider consulting with a financial advisor or health insurance expert to get personalized guidance.

Fun Facts

HSA vs. PPO: Choosing the Best Health Plan for You • 7ESL – Source 7esl.com

Did you know that HSAs can be used to pay for over-the-counter medications and menstrual products? PPOs, on the other hand, often offer discounts on gym memberships and other wellness programs. These little-known perks can add up to significant savings over time.

How to Choose?

HSA vs. FSA: Understanding the Differences • 7ESL – Source 7esl.com

To choose the best health insurance plan for you, it’s essential to assess your needs and preferences. Consider your age, health status, financial situation, and long-term healthcare goals. Research different plans and compare their coverage, premiums, and deductibles. Consult with a financial advisor or health insurance expert to get personalized guidance.

What If?

HSA vs. FSA: What’s the Difference? | Blue Ridge Risk Partners – Source www.blueridgeriskpartners.com

What if you’re not sure whether an HSA or PPO is right for you? Consider a hybrid plan that combines features of both. Some plans offer a high-deductible plan with a health savings account option. This allows you to take advantage of the tax benefits of an HSA while still having the flexibility and coverage of a PPO.

Listicle

HSA vs FSA: Understanding the Differences – Consolidated Personnel Services – Source cpspeo.com

Here’s a brief listicle to help you remember the key differences between HSAs and PPOs:

- HSAs offer tax benefits and the potential for long-term savings, while PPOs provide more comprehensive coverage and lower out-of-pocket costs in the short term.

- HSAs are paired with high-deductible health plans, while PPOs offer a network of healthcare providers.

- HSAs can be used to pay for a wide range of qualified medical expenses, including dental and vision expenses.

Question and Answer

Q: Can I have both an HSA and a PPO?

Yes, some hybrid plans combine features of both HSAs and PPOs.

Q: What is the maximum amount I can contribute to my HSA in 2023?

The maximum HSA contribution limit for 2023 is $3,850 for individuals and $7,750 for families.

Q: Can I use my HSA to pay for my health insurance premiums?

No, HSAs cannot be used to pay for health insurance premiums.

Q: What happens if I withdraw money from my HSA for non-qualified expenses?

Withdrawals from HSAs for non-qualified expenses are subject to income tax and a 20% penalty.

Conclusion of HSA Vs PPO: Understanding The Differences For Your Healthcare

Choosing the right health insurance plan is an important decision that can impact your financial and physical well-being. By understanding the key differences between HSAs and PPOs, you can make an informed choice that aligns with your individual needs and preferences. Whether you prioritize tax benefits and long-term savings or prefer more comprehensive coverage and lower out-of-pocket costs, there is a plan that’s right for you.